In July 2008, Brent crude oil prices reached $148 per barrel “and we saw a lot of pushback from the market but nowadays when I mention $150, there is no pushback,” said Christian O’Neill, senior analyst at Bloomberg Industries during a GARP webinar October 11, 2012. He proceeded to walk the audience through the key factors affecting current supply and demand of this vital commodity.

O’Neill’s presentation showed that oil leveraged energy and petroleum (E&P) stocks have strongly outperformed the S&P 500 in the period since March 2009. “Energy has been the beta sector of the market,” said O’Neill, because energy stocks tend to magnify whatever is happening in the market.

But what’s behind it all? First O’Neill itemized the demand factors: gross domestic product (GDP), GDP growth, demographics, fuel efficiency, and the European effect.

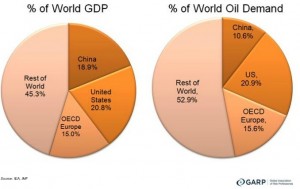

He showed a pie-chart in which China has 18.9% of the world GDP, yet only 10.6% of the world oil demand. That’s because there is a closer correlation with GDP growth and the oil demand. “China’s important because 65% of the incremental oil demand comes from there,” O’Neill said.

Demographics affect the demand, as well. In terms of the average miles driven by age group, the peak amount of driving occurs in the 35-54 age range, and then declines for the 55-64 age range, and so on. “Over the next seven years, in the US, the [population of the] peak age range will decrease by 3.8 million people,” said O’Neill.

The demographics effect is exacerbated by the decreasing gasoline consumption of new fuel-efficient cars. There is also a decreasing demand for gas, due to continued high prices at the pump, O’Neill noted. The psychology of having cheap gas increases driving behaviour.

In OECD Europe, the “demand destruction” has accelerated. In 2007 the rate of erosion was 0.1 million BPD (barrels per day) and now it is around 0.3 million BPD. “Given the deleveraging that’s occurring in Europe, that will translate into below-trend oil demand,” O’Neill remarked.

The supply factors are largely positive, according to O’Neill, and oil supply is projected to exceed demand growth in 2013. US crude oil production peaked in the mid-1980s, then reached its lowest point in 2009, but it has since rebounded and “every quarter it seems they are finding new oil-producing zones.” With the advent of fracking and horizontal wells, the US oil supply has grown. “We think there is continued underestimation of the resilience of the supply,” he said.

Now for the “wild cards”: the monetary and geopolitical factors. O’Neill showed the fluctuations of the crude oil supply through the Strait of Hormuz, especially how it reacted to recent events. “There is not enough spare capacity [for moving crude oil] if Middle East tensions mean we lose the Strait.”

The US dollar and oil prices are operating nearly in tandem. O’Neill said that, prior to 2000, the correlation between the dollar and the price of West Texas Intermediate (WTI) crude oil used to be 0.23. Post-2000, the correlation between the two has jumped to 0.82. The boosted correlation he attributed to “investors using commodities as a hedge to the US dollar,” especially from 2011 onward.

Demand will lessen, supply will increase … BUT things might still go haywire with the monetary and geopolitical factors. O’Neill mentioned the “FUD” (acronym for: fear, uncertainty, doubt) that affects current markets.

Post-presentation Q & A

O’Neill is an insightful and sought-after commentator on energy issues. His presentation spurred questions afterward on a range of issues. The following is a collection of his pronouncements in response to audience questions:

- Investors will continue to use crude oil as a hedge.

- Power plants create a demand for crude oil in developing nations. Since this is comparatively “dirty” energy, the demand will lessen over time because developing nations have growing environmental concerns.

- Canadian crude oil is too valuable to ignore. If the pipeline to the US does not go ahead, the oil will go an alternative route and get into the market via BC.

- A lowered price of crude oil does not show up clearly at the pumps, because there is a tightened supply of the refined product caused by accidents in California, and recent closures of refineries.

- The reason for the divergence between American and European prices is “a function of logistics,” O’Neill said. “A glut of crude oil is trapped mid-continent” due to complications with the infrastructure.

- Wind could be a piece of the energy market but is not a strong contender because it is not a constant source and therefore it requires a back-up source such as natural gas.

- Ethanol is “pseudo crude oil,” said O’Neill, because it “lightens the burden” on demand. However, the ten percent pool limit is rapidly being reached.

- Iraqi oil production will require stability and investment in order to succeed. “It will take longer than you think to set it up.” He compared the Iraqi situation to that of Brazil, which was “another source of visible oil” that has run into delays.

With that, the oracle’s sixty minutes were up. ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=511061&s=1&k=2E0F81C8C1622F72412802A2501466E2