Basel III and Beyond: Capital Management and Funding Strategies

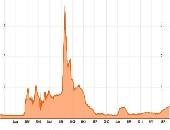

“Banking profitability will remain below pre-financial crisis levels for the near term,” said Mario Onorato, Senior Director, Balance Sheet and Capital Management at IBM and Visiting Professor at Cass Business School in London, UK. He was addressing a June 25, 2013 webinar organized by the Global Association of Risk Professionals (GARP) on the effects of Basel III. Banks have potential funding problems due to mismatched maturity periods, among other challenges. Onorato cited a Goldman Sachs report that forecasts a 1 percent decline year-over-year in revenue for banks in North America. There were comparable dismal reports by Citi and UBS about […]

Hollywood Math

To showcase its mathematics software, a firm usually works through idealized examples from its client base. Sometimes, the firm will consider a real-life problem. The firm seldom turns to the silver screen for inspiration—yet that was the hook that drew in a webinar audience on June 19, 2013. Jonny Zivku, Product Manager at Maplesoft, provided an entertaining tour of Maple software (version 17), as applied to math problems encountered in the movies. Zivku quickly moved from a discussion of the basic math problem (13 X 7 = 28) encountered by Abbott and Costello in the 1941 classic In the Navy […]

Risk Models: From Governance to Validation: Part 3. Examples

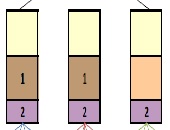

“The calculation of the spread on the tranches is quite involved but essentially boils down to dependencies between names,” said Frederic Siboulet, Principal at iEpsilon and the third of three speakers at a GARP webinar on risk models held June 11, 2013. The tranches in structured credit products he referred to were apparently diversified, but in reality not so. Siboulet chose to illustrate the subtle and embedded risk of models with actual structured product examples. In particular, he said that “We must not overlook the importance of the parameters and their interpretation.” The first example involved stressed correlation within a […]

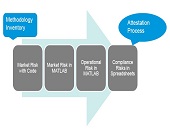

Risk Models From Governance to Validation: Part 2. A Model of Model Management

No longer should a firm just use financial models; it should have a “model of model management,” said Donna Howe, Chief Risk Officer at Sovereign Bank. She was the second of three speakers at a June 11, 2013 webinar on risk models organized by the Global Association of Risk Professionals (GARP). Such a “meta-model” would help a firm sort and track models. Howe said that risk models must be understood within the wider frame of compliance and other non-prudential risk. Model parsimony, or Occam’s razor, that was recommended by the first speaker, is good but in the real world “cannot […]

Risk Models From Governance to Validation: Part 1. Don’t Forget the Story

The best practices of risk models–and model building–boil down to one thing: “we can’t forget the story behind it,” said Peter Went, VP, Banking Risk Management Programs at GARP. He was the first of three speakers at a GARP webinar on risk models held June 11, 2013. “There must always be a qualitative story expressible in quantitative terms.” And, vice versa, since any model reduces the complexities of the real world into snippets of mathematical relationships, the opposite must hold true. Went, a trained econometrist, described three main types of models. Fundamental models are based on rules relating basic variables […]

Ain’t Misbehavin’. Part 2: What Makes a Good Committee?

“Good committees make good decisions,” said Arnold Wood, guest speaker at the CFA Society Toronto on June 3, 2013. On the TV show Who Wants to Be a Millionaire, whenever the contestant turns to the crowd for help with an answer, the crowd is right 91 percent of the time, said Wood, who is president and CEO of Martingale Investments and a specialist in behavioural finance. The first part of his talk described common errors in individual thinking. But what makes a good committee? The composition of committees can be tricky. Too often, there is an appearance of diversity but […]

Ain’t Misbehavin’. Part 1: Overconfidence and Illusion

“It’s not our ability that makes us, it’s our choices.” With this quotation from Harry Potter, Arnold Wood, President and CEO of Martingale Investments proceeded to show how, in case after case, a good grasp of behavioural finance could explain the workings of the typical investment committee. Wood was speaking to a few dozen charterholders at a luncheon sponsored by the CFA Society Toronto at the historic National Club in Toronto on June 3, 2013. Wood wove his commentary around three themes: key habitual errors of decision-making, the composition of committees, and the behaviour of the chair of the investment […]

Financial Shenanigans: Forensic Accounting in Practice

There are ample opportunities for financial shenanigans in North American companies, according to Howard Schilit, founder of Schilit Forensics LLC and author of the classic Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports, first published in 1993 and now in its third edition. He led a mid-day seminar on characteristics of poor accounting practices at the CFA Society Toronto downtown offices on May 30, 2013. “Financial shenanigans are not necessarily illegal,” explained Schilit, but they are practices that “are not nice to perpetrate on someone” and could, if unchecked, slip into criminality. Given the extensive subject […]