Public vs Private Banks in India and China

“Public sector banks perform worse than private banks In India whereas there is no significant performance difference for the two sectors in China,” said Dr. Rajan Singenellore, Global Head of the Default Risk and Valuation Group at Bloomberg. He gave an overview of operational performance and credit risk trends in Banking in Emerging Markets, and was the third of three webinar panellists on November 20, 2014, organized by the Global Association of Risk Professionals. For both countries, Singenellore compared government-owned banks with private sector banks. The terminology is different: India has public sector undertakings (PSU) banks whereas China has state-owned […]

“Expect More Niche Customer Targeting”

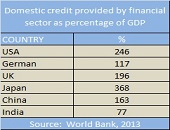

In India and China, “large state-owned banks often have a significant constraint on their ability to manage liabilities,” said Professor Moorad Choudhry from the Department of Mathematical Sciences at Brunel University and author of Principles of Banking. He was the second of three panellists at the webinar Banking in Emerging Markets held on November 20, 2014, organized by the Global Association of Risk Professionals, and his role was to describe “operational realities.” The 2018 advent of new Basel III rules for capital and liquidity requires 100 percent compliance with new rules on the liquidity coverage ratio (LCR) and the net […]

“Lending Will Be Marketing Gimmick”

What will be the effect of Basel III on banks in emerging markets? “Commercial banks will become less interested in providing loans,” said Dr. Michael C. S. Wong, the first panellist in a webinar on Banking in Emerging Markets held November 20, 2014, and sponsored by the Global Association of Risk Professionals. He is Associate Professor of Finance at City University of Hong Kong, and Chairman at CTRISKS Rating. Wong summarized the challenges of the new Basel III regulatory regime, with its tougher capitalization and liquidity requirements. A global systemically important bank (G-SIB) will have additional capital and cash-holding requirements, he said, […]