Ethics and Risk Management: Part 3

A panel of four specialists convened to discuss various aspects of ethics in risk management in a GARP-sponsored webinar on June 21, 2012. (Click for Part 1 and Part 2 of this summary.) The fourth and final speaker was Roger Miles, Director, NudgeGlobal. He spoke on risk control lessons learned from the banking crisis. In the financial sector, he said, “UK-enforced self-regulation was a good idea in theory.” A bank can realize an ever-increasing profit from a new, complex product, but the regulator has limited resources, therefore, there is an essential asymmetry of information that cannot be overcome. However, in […]

Ethics and Risk Management: Part 2

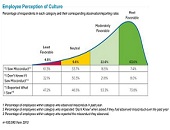

A panel of four specialists convened to discuss various aspects of ethics and risk management in a GARP-sponsored webinar on June 21, 2012. Part I of this blog posting summarizes comments by Peter Went and Hans Helbekkmo. The third speaker was Dan Currell, Executive Director, Corporate Executive Board (CEB). He presented empirical findings from the CEB on-line survey that asked essentially two questions: “Have you seen misconduct? And if so, what was it?” I have mixed feelings when I listen to survey results. I listen as someone who craves a snapshot of current opinion; I also listen as someone who […]

Ethics and Risk Management: Part I

Risk professionals are called upon to monitor, measure, and manage risk throughout corporations. It’s all too easy to get caught in the thicket of regulations, methodology, and topical issues. Thank heavens that that, every once in a while, the Global Association of Risk Professionals (GARP) encourages its membership to look at the bigger picture: ethics. A panel of four specialists convened to discuss various aspects of ethics in risk management in a webinar on June 21, 2012. When it comes to doing the right thing, it is no longer just a good conscience that should motivate someone to report unethical […]

Using Informatics to Keep Up with the Data Deluge

If you’re feeling a tad overwhelmed by the rate of publications appearing lately, spare a little sympathy for those who use PubMed, a database of references and abstracts on life sciences and biomedical topics. In 1980, articles were being added at a rate of 250,000 per year; by 2011 that rate had quadrupled to one million per year—flooding in from 39,000 different refereed journals. The problem is, only ten or twenty of these articles might bear relevance to the work an individual researcher is carrying out. The question becomes: how does one efficiently find those ten or twenty papers? In […]

Zombie Banks Part 2. A Call for Change

Given the current high coolness quotient of anything “zombie,” a webinar about “zombie banks” is guaranteed to pique the interest of even the non-bankers out there. (Kudos to the non-financial types who made it through Part 1 and the discussion of interest rates.) But really, “zombie” is nothing more than a highly picturesque way to refer to something that is kept in motion or presumed viable long after it normally would have expired. “Zombie yogurt,” anyone?To recap Yalman Onaran’s definition in Part 1 of this posting, a zombie bank is a financial institution that continues to exist “even though the […]

Zombie Banks Part 1. Tough Love

George A. Romero, the moviemaker who popularized the witchcraft legend of the “walking undead,” would likely be astonished to hear the term applied to real financial institutions, but “Zombie banks” does capture the concept well. On June 5, 2012, Yalman Onaran, author of “Zombie Banks: How Broken Banks and Debtor Nations Are Crippling the Global Economy,” and financial reporter at Bloomberg News, spoke at a panel convened by GARP (Global Association of Risk Professionals) to discuss the phenomenon of banks which exist to fulfill a regulatory purpose but are not in themselves economically viable. Onaran said the first response to […]

Reality vs Expectations: What Risk Managers Can Learn from the NFL

Arriving a little late at the CFA Society Toronto luncheon on June 4, 2012 at the National Club on Bay Street, I had a lucky choice of seat at the “hodge podge” table near the back. My two nearest neighbours at the table had driven from Simcoe to Toronto that morning (a minimum two-hour trip) for the express purpose of meeting the featured speaker, Roger Martin, Dean of Rotman School of Management. One said he had not only read and enjoyed Martin’s latest book, Fixing the Game: Bubbles, Crashes, and What Capitalism Can Learn from the NFL, he had also […]