It’s all about the benchmark

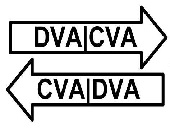

The costs of financial transactions (in either the bond or stock markets) are quoted as bid and ask prices relative to the prevailing market price. But what, really, is meant by “prevailing market price” of thinly traded bonds? Two panellists discussed fixed income transaction cost analysis (TCA) at a webinar sponsored by the Global Association of Risk Professionals on December 12, 2017. Paul Daley, Managing Director at BondWave Information Lab, compared the market microstructure for stocks and bonds. BondWave LLC is a financial technology company and registered investment advisor that provides solutions to facilitate individual bond investing. “Data is the […]

Lower Bond Trading Costs

As the fixed income market evolves, what are the challenges and general directions of transaction cost analysis (TCA)? How can bond investors spend their money more wisely? “The same kind of conversation we used to have with equity dealers … can now occur with fixed income dealers. That means competition will drive down transaction costs,” said Henry Marigliano, Director at FIS Global Trading. FIS is an international provider of financial services technology. He was the was the first of two panellists discussing fixed income transaction cost analysis at a webinar sponsored by the Global Association of Risk Professionals on December […]

Early Warning Signs

“Overall, the energy sector remains stressed,” said Irina Baron, Associate Director at Moody’s Analytics. Baron was the third and final panellist discussing new dynamics in the handling of financial risk management in the energy sector at a webinar sponsored by the Global Association of Risk Professionals on November 29, 2017. Based on expected default frequency (EDF), 75 percent of US publicly-traded companies in the energy sector are not investment-grade risks. “Agency ratings give us a sense of which firms are more likely to default,” she noted. The drawback is that the realized default rate cannot be forecast. However, the expected […]

Managing Risk in Volatile Sector

Market observers have conflicting expectations, especially in the highly changeable energy sector. How can a talented analyst stay on top of it? Mehna Raissi, Senior Director at Moody’s Analytics, was the second of three panellists discussing new dynamics in the handling of financial risk management in the energy sector at a webinar sponsored by the Global Association of Risk Professionals on November 29, 2017. “Between 2008 and 2013, we were worried about rising oil prices,” Raissi said. However, “in the second half of 2014, oil prices came down and the headlines read: Recession caused by low oil prices.” Oil prices […]

New Dynamics in Energy Sector

How can financial risk be measured and managed in a volatile industry such as the energy sector? What are some of the common industry challenges? Due to low commodity prices and technological changes in the industry, there are new dynamics in the handling of financial risk management in the energy sector. Three speakers addressed specific changes in a webinar sponsored by the Global Association of Risk Professionals on November 29, 2017. “Sometimes the things we think we know, we don’t,” said Gordon Goodman of NRG Energy, the first of three speakers at the webinar. Goodman’s claim to fame is publication […]