Measuring the ROI of GRC. Part 2: Solutions to “Absorb Regulatory Demands”

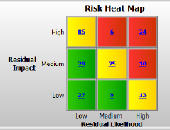

An unprecedented amount of new regulations “has led to risk assessment fatigue,” said John Kelly, Market Segment Manager in Business Analytics at IBM. He was the second of two speakers who addressed a GARP webinar audience on March 28, 2013 on the topic of the return on investment (ROI) on governance, risk assessment, and compliance (GRC). Most of the presentation referred to the study “Guidebook: Understanding the Financial Value of GRC Management” released in October 2012 by Nucleus Research that was talked about by Hyoun Park in the first part of the presentation. When it comes to regulation, there is […]

Measuring the ROI of GRC. Part 1: “Your Mileage May Vary”

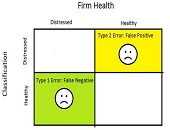

When looking at the return on investment (ROI), “it’s not about getting the highest number—it’s what is most defensible,” said Hyoun Park, Principal Analyst at Nucleus Research. Park was speaking on March 28, 2013 to a webinar audience on the topic of how to quantitatively measure the ROI on governance, risk assessment, and compliance (GRC). The two-speaker panel, convened by the Global Association of Risk Professionals (GARP), based their remarks on a study released in October 2012 by Nucleus Research (cover shown here). The report states “this research was conducted in context of the usage of IBM OpenPages, a software […]

Global Challenges in Chemicals & Energy: Standardizing & Accelerating R&D

“The iPhone of experimental chemistry” standardizes and simplifies experimental chemistry in a paradigm-shifting manner, according to Michael Schneider, SVP of Chemspeed Technologies, and the holder and author of more than 30 publications and patents. He was delivering a presentation on March 19, 2013, through a webinar organized by Chemical & Engineering News (C&EN). “The iPhone of experimental chemistry” is based on a sleek desk-sized compartment that apportions chemicals in ”1-2-5” money analogously staggered (but in mmoles instead of cents) , ready-to-apply formats. It dramatically simplifies the experimental work in a multitude of “applications” in traditional experimental lab work and/or as […]

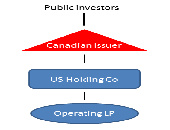

Foreign Asset Income Trusts

“Income trusts should be viewed as a story in capital markets innovation,” said Jon Northup of Goodmans LLP. He was speaking at a luncheon at the National Club in Toronto, sponsored by the Chartered Financial Analysts (CFA) Society Toronto on March 5, 2013. The introduction of SIFT (Specified Investment Flow-Through) rules by the Canadian government in October 2006, “effectively eliminated Canadian income trusts,” Northup said. There are two exceptions: (1) a trust that does not involve Canadian real estate, immovable or resource properties used in carrying on a business and (2) a trust that qualifies as a REIT (real estate […]