Automated Trading with MATLAB

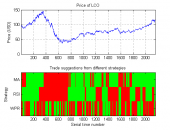

Stuart Kozola, product manager for computational finance at MathWorks, demonstrated examples of trading systems using MATLAB during a webinar on August 21, 2012. In the first half he discussed how to develop an automated trading decision engine. This meant identifying a successful trading rule, extending the trading rule set, and automating the trading rule selection. In the second half of the webinar he showed implementation of the automated trading, with a caveat that these would require testing prior to integration and execution in the real-life scenario. The worked problem involved Brent oil futures. The first challenge was to identify profitable […]

Executive Compensation: Insights for Investors

If you pick the right people and give them the opportunity to spread their wings and put compensation as a carrier behind it you almost don’t have to manage them. – Jack Welch Catherine McCall and Damian Yu, both principals at Hugessen Consulting , provided a lively overview of issues in executive compensation to an afternoon audience at the CFA Society Toronto offices on August 20, 2012. The duo first outlined the current governance and market environment of compensation, then gave helpful pointers for deciphering management information, and concluded with “hot topics” in the area. Executive compensation deserves the attention […]

Impact of Basel III on Capital Instruments. Part 2: Football vs. Soccer

On August 16, 2012, speaking at a webinar hosted by the Global Association of Risk Professionals (GARP), three panellists gave a perspective on the changes Basel III would wreak on capital instruments. Click here for Part 1. The second speaker, April Frazer, Director of Client Solutions Group at Wells Fargo, gave an overview of the impact of the US Basel III proposal on market dynamics. Due to regulatory limitations that she is subject to as a member of a financial institution, her talk is not reported on here. Steve Sahara, Global Head of DCM Solutions and Hybrid Capital, Crédit Agricole […]

Impact of Basel III on Capital Instruments. Part 1: Ramp-up in Capital

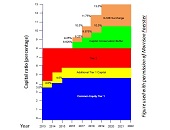

On August 16, 2012, three panellists gave a perspective on the changes Basel III would wreak on capital instruments. It was a highly detailed talk, delivered at high speed, with many qualifications made to the main points, but the sponsoring organization GARP has done a tremendous service to its membership by gathering together these experts. There are some excellent summary slides (link below). This two-part posting showcases the top messages from the three experts, Dwight Smith, April Frazer, and Steve Sahara. In June 2012, three US regulatory bodies (the OCC, the Federal Reserve Board, and the FDIC) proposed three sets of […]

Tree Bagger & Tree Booster: MatLab for Data-Driven Fitting

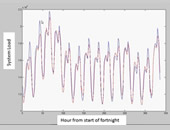

Let’s say you want to create a predictive model without assuming an analytical form to the model. How would you go about it? On August 14, 2012, Richard Willey, Technical Marketing Manager at MathWorks, demonstrated via webinar how input data could be fit using machine-learning approaches. The emphasis here is data-driven, as opposed to model-driven, fitting. “A limitation of regression techniques is that the user must specify a functional form,” said Willey, and the choice of that model is usually based on the domain model. Typically the data points are fit with high-order polynomials or Fourier series. Or, the user might run the data […]

Implications of the Euro Zone Crisis

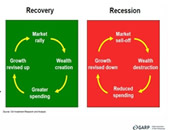

When it comes to financial debt in the Euro Zone, “deleveraging has barely begun,” said Daniel Wagner, author and risk consultant. “It’s a long and winding road.” On August 7, 2012, Daniel Wagner, CEO of Country Risk Solutions, a US-based cross-border risk management consulting firm, addressed a Global Association of Risk Professionals (GARP) audience about the Eurozone crisis. Wagner, author of Political Risk Insurance Guide, and Managing Country Risk, published in 2012, spoke on a range of related topics. Wagner’s talk was far-ranging and comprehensive (78 slides in 45 minutes). He spoke about the impact of debt: in particular, the effect […]