Risk Units & Risk Accounting

“In the absence of a standardized and universally accepted method of calculating exposure to risk, are accuracy, integrity and timeliness achievable?” asked Peter Hughes, Managing Director, Financial InterGroup (UK). He was the fourth of four panellists to present at the GARP webinar on risk data aggregation held July 22, 2014. Hughes was speaking with reference to the Basel Committee on Banking Supervision (BCBS) article 239, which spells out principles of accuracy, integrity, and timeliness for risk data. There’s a mixed bag of methods used to identify and quantify exposure to risk, Hughes noted. Quantitative modelling, accounting methods, key risk indicators, […]

Where is the Common Thread?

Thanks to “Rube Goldberg infrastructure” and a lack of attention, banks “have been mixing together data that have no common thread,” said Allan D. Grody, founder of Financial InterGroup Holdings. “Now is our chance to fix the plumbing.” Grody was the third of four panellists to address the July 22, 2014 GARP webinar on changes to risk data aggregation and reporting. His talk continued a theme of improved risk data management that he has spoken about before to GARP audiences. The “astonishing” aftermath of the 2008 Lehman fiasco—where banks were scrambling to determine exposure to a bankrupt counterparty—“has become the […]

Swap Data Reporting

One of the primary purposes of swap data reporting, as explained by James Schwartz, Counsel at Morrison & Foerster LLP, is to permit regulators to identify the swap exposures of market participants—which they found themselves unable to do during the financial crisis. Schwartz spoke as part of a four-person panel on challenges to risk data aggregation, reporting and recordkeeping organized by GARP on July 22, 2014. Schwartz gave an overview of the US swap data reporting requirements under the Dodd-Frank Act. “It’s important to note timing,” he said with regard to U.S. Commodity Futures Trading Commission (CFTC) regulations and Basel […]

Challenges to Risk Data Aggregation: Overview

Will financial institutions be able to respond to new challenges of risk data aggregation, reporting and record-keeping? Peter J. Green, Partner of Morrison & Foerster LLP, opened the four-panellist webinar organized by GARP on July 22, 2014, to discuss new risk data aggregation, risk reporting and recordkeeping principles. He indicated that the recent financial crisis had caused regulators to see many gaps in risk reporting and aggregation due to deficiencies in banks’ IT and data architecture. The Financial Stability Board (FSB) gave a mandate to the Basel Committee on Banking Supervision (BCBS) “to develop principles for effective risk data aggregation […]

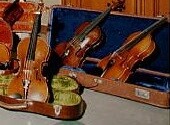

Investing in Emotional Assets

When Morty discovered my vacation plans this year included Cremona, that put a bee in his bonnet. Did I know it was the home of the famous Stradivarius workshop? Was I going there to check out violins? Yes and no, I said. My preference was to cycle along the Po valley and sip espresso near the Zodiac Tower. “Maybe you should think twice about your visit,” Morty said. “I happen to have it on good authority that beautiful collectibles can be a solid component of your portfolio.” “Please Morty, don’t make wild-eyed guesses about other people’s money,” I said. Especially […]

Interview with William Bernstein: The Paradox of Wealth

I could hear the laughter from down the hall. “Cheeseburger,” cried Morty. Cheeseburger? I saw he was holding a back issue of the Financial Analysts Journal. (It’s no secret that we fall behind on our reading here during the busy months.) “You’ve gotta interview this guy,” declared Morty. “Anyone who can work the word ‘cheeseburger’ into the pages of this esteemed journal… well… he likely has something interesting to say.” William Bernstein did indeed have some very interesting things to say. The interview below is the vegan-friendly edition, though; if you want to see ‘cheeseburger’ in print you’ll have to […]