Sentiment Analysis and Risk Layering

“Sentiment analysis is ripe for development,” said Cliff Rossi and he was not speaking about the newest remake of Jane Eyre, but about new trends in financial risk management. Rossi, the Tyser Teaching Fellow at the business school of the University of Maryland, was addressing a GARP (Global Association of Risk Professionals) audience as the second of three panellists on “Modernizing Financial Risk Management: The Changing Technology Paradigm” on May 22, 2012. There are three main categories of enhancements Rossi would like to see in risk management technology. First on his wish list is a greater breadth of data over […]

“We Need to Fix the Plumbing”

Allan Grody is a man with a mission. The fall-out from the financial meltdown has shone a light on many things that need fixing within the financial system, and of these, Grody is focusing on one especially leaky, corroded pipe. Grody, president of Financial Intergroup, was addressing a GARP (Global Association of Risk Professionals) audience as the third of three panelists on “Modernizing Financial Risk Management: The Changing Technology Paradigm” on May 22, 2012. Early in his presentation, Grody showed a complex summation diagram. Titled “Need to Fix the Plumbing,” it was a kind of map, one that deserves a place […]

Real-Time Risk Analytics, SAS Style

“Analysts in capital markets get pummeled with vast quantities of information,” said Jeff Hasmann, “sometimes receiving as many as twenty newsfeeds per day. How are they to make sense of it all?” Hasmann was the first of three panelists speaking at the Global Association of Risk Professionals (GARP) webinar, “Modernizing Financial Risk Management: The Changing Technology Paradigm” on May 22, 2012. There is a push to modernize financial risk management from both above and below. Besides handling information overload, Hasmann noted there are several reasons to modernize: evolving regulations, improvements in efficiency to be gained, and needs for standardization. Hasmann, […]

Joost Driessen Discusses Liquidity Effects in Bonds

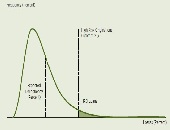

Put away the crossword and the sudoku: it’s the “credit spread puzzle” that’s occupying some leading financial minds. On May 3, 2012, Prof. Joost Driessen of Tilburg University spoke to a Global Association of Risk Professionals (GARP) webinar audience about recent work done by his research group to solve this puzzle. The term “credit spread puzzle” refers to the fact that credit spreads are much higher than can be justified by historical default losses. A typical example Driessen cited was a long-term AA bond that had an expected default loss of 0.06% yet whose average credit spread, calculated using real-life data, was 1.18%. More […]