The application of behavioral analysis to banking will touch nearly every corner of the financial sector. Is the financial institution you work for ready? Are you ready?

Traditional economic analysis assumes that individuals and groups rationally maximize their outcomes, and that consumer consumption is defined by utility maximization.

In contrast, behavioral analysis does not assume rationality. It seeks to understand individual or group behavior, which is often not rule-based, said Joe Mattey, Vice President of Enterprise Risk Analytics, and Chief Risk Officer at USAA. He was one of two panellists on March 13, 2018, speaking about how banks can leverage behavioral analytics. The webcast was organized by the Global Association of Risk Professionals (GARP).

Three aspects of behavior have a significant effect on consumer choices: a preference for action over reflection; confirmation bias, which makes a consumer notice only what reinforces his view; and framing, which determines whether something is interpreted as a loss or a potential win, Mattey said.

The current industry leaders in the field of behavioral analysis are high tech companies: Google, Amazon, and Facebook. These companies constantly experiment with the best way to present material on a web page or Facebook page and how to otherwise tweak consumer behavior. “The Google Analytics platform provides a lot of tools and techniques so you can do cohort analysis,” said Mattey. Rather than looking at all users as one unit, the dataset can be further subdivided into several closely related groups for analysis. Similarly, social media analytics parses social media data looking for brands, product and ad placement, and sentiment analysis.

Old versus new treatments

Mattey contrasted traditional versus behavioral analyses for two cases familiar to the financial sector.

Companies that offer automobile insurance want to know the likelihood of customer claim. Traditional analysis would look at data from the insurance form filled out by the applicant: age, driver history, geographic location, type of car, and so on. A behavioral analysis approach would consider data from nonstandard sources, such as a device that monitors the raw data of driving: speed/acceleration, hard braking, miles driven, etc.

Another example is the likelihood of default on a mortgage. Traditional analysis considers quantities such as loan-to-value ratio, debt-to-income ratio, and the loan amount. A behavioral analysis approach considers data from nonstandard sources, such as social media posts, that could reveal things such as payment hierarchy, equity extraction activity, and purchase activity patterns.

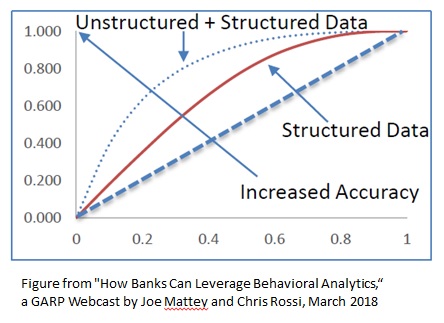

The second panellist, Clifford Rossi, Professor of Finance at University of Maryland, contrasted the presence of structure in the data sources. Traditional analysis uses data “available in some processed form that can be ingested by analytic models.” Think: numbers on a form. Behavioral analysis uses unstructured data that, although digitized, “exists in a form that typically does not conform to a specific data model.” Think: text from social media postings or signals from the Internet of Things.

It is this unstructured data that threatens to overwhelm current capabilities. Interactive Data Corporation, a company that provides financial market data, “estimates unstructured data will go to 40 zettabytes by 2020,” Rossi said. [For reference: 1 ZB = 1 trillion gigabytes = 10^21 bytes]

But don’t despair. If firms can figure out how to combine both types of data, he says the predictive accuracy of models will improve greatly. ª