“Worse Than Silverfish”

Some authors go to great lengths to make their monographs up-to-the-moment. In this excerpt, the authors refer to a popular and critically acclaimed TV series. It’s a calculated risk. They use an obsession of the (fictional) characters—the money they are amassing—to tie into the very real phenomenon of hyperinflation. Today’s excerpt comes from page 103 of the book The Evolution of Money by David Orrell and Roman Chlupaty (Columbia University Press, 2016). “To visualize how hyperinflation can affect one’s personal savings, fans of the TV show Breaking Bad will recall the episode in season 5 in which it is shown […]

War, Kidnapping, Data Theft

War, kidnapping, and data theft: Is it some fiction pot-boiler that’s come over the transom? No, it’s the chapter on how the gross domestic product (GDP) came into being in Germany. Today’s excerpt comes from pages 117-8 of the book The Power of a Single Number: A Political History of GDP by Philipp Lepenies, translated by Jeremy Gaines (Columbia University Press, 2016). “[John Kenneth] Galbraith was surprised by the results of his calculations and surveys because they, for the first time, provided a clear picture of the Nazi economy. Because no set of tools comparable to gross national product calculation existed on […]

Platform of the Future

What will be the ideal modelling platform of future bankers? It will need to contain key functionalities in model execution, scenario management, and a “risk engine” that will deliver answers for multiple horizons at the loan level. Furthermore, it should implement the most advanced modelling suites, reduce the quants’ time to develop models, and contain simulation capabilities for stress testing and beyond. This bold vision of the future was presented by Martim Rocha, Advisory Business Solution Manager at SAS. He was the second of two presenters at the February 25, 2016, webinar offered by the Global Association of Risk Professionals […]

Integrated Data and Modelling

How can today’s bankers prepare for tomorrow’s challenges? Consider the financial models built using available data. Data collection and financial modelling used to be conducted in each different silos of the bank, with credit separate from market, which was separate from treasury and other groups). Then data became “managed” and modelling was moved to “platforms” which did not mix well between the various silos. A few brave souls began to integrate the data management for different groups of the bank. Other brave souls tried to integrate the modelling. This was the phase of integration achieved through batch calculations. Now, the […]

The Latest & Greatest

Although the next round of changes to accounting standards will not come into effect until 2018, alert financial analysts should already be asking companies about how they plan to address them, according to Canada’s top accountant. “Pay attention now, because companies do have the option to adopt” and some, such as Canadian banks, are adopting IFRS 9 early, said Linda Mezon, Chair of the Accounting Standards Board (AcSB). She was speaking at a webinar on January 21, 2016, to members of CFA Society Toronto and CPA Canada on the recent developments in accounting standards and emerging trends impacting financial statements. […]

“Feedback Difficult to Obtain”

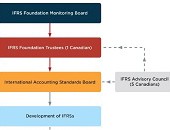

In the financial world, change is a constant. Regulators can barely keep up. Who decides what regulatory changes need to be made? And who can apply the brakes, if a certain type of change is having unintended consequences? Canada’s top accountant briefed the members of the CFA Society Toronto jointly with CPA Canada at a webinar on January 21, 2016. “Feedback is important but difficult to obtain,” said Linda Mezon, FCPA, FCA, who is the Chair of the Accounting Standards Board (AcSB). She summarized how Canadians and the AcSB influence the development of International Financial Reporting Standards. “The Accounting Standards […]

Three-Way Damage

Do you remember that cute VW video, “The Force”? The one where the little boy, dressed up as Darth Vader, can’t get a reaction from anyone or anything, even his dog, when he tries his super-powers on them? Then, Dad drives up in his VW Passat and the Vader-wannabe is, magically, able to get the lights to flash. The camera pans to parents looking out the window. Dad gives a conspiratorial grin as he clicks the remote control. On September 18, 2015, world markets were rocked by news that Volkswagen had knowingly falsified its emissions of toxic nitrogen oxides. The […]

Watch Out for Hippos

Is your company managing risk well enough to make the most of opportunities as they appear? Or does it suffer from risk paralysis? As a company matures, it moves from trying to identify all possible risks (and mitigating them), to saying “what risks will give me the chance to pursue an opportunity,” said Martin Pergler, Founder and Principal of Balanced Risk Strategies, Ltd. He was the first of two panellists at the webinar titled Explore Your Opportunity Landscape by Harnessing Your Risks, sponsored by the Global Association of Risk Professionals on November 18, 2015. Pergler began by making a memorable […]

Harnessing Your Risks

Before your company undertakes economic risks, what systems should be firmly in place? “Good risk management allows us to take risks we wouldn’t normally do,” said Brenda Boultwood , Senior Vice President of GRC Solutions at MetricStream. (GRC is the acronym for governance, risk management and compliance.) She was the second of two panellists at the webinar titled Explore Your Opportunity Landscape by Harnessing Your Risks, sponsored by the Global Association of Risk Professionals on November 18, 2015. A company needs superior risk intelligence in order to understand the risks they plan to harness. Technology can be leveraged to capitalize […]