Volunteer Appreciation Night

National Volunteer Week is a time to recognize the efforts of volunteers across Canada. This year it took place April 21 to 27, 2013 and we dropped by “Volunteer Appreciation Night” hosted by CFA Society Toronto on April 25, 2013 to view some fine magic entertainment by Revel Magic (see magician with flaming business card below), and to hobnob with volunteers. CFA Society Toronto has 17 different committees, plus a board of directors, so there is ample opportunity for community-minded members to find an area to which they can donate their time and talent. Following are interviews with three members of CFAST […]

Bed-Time Tales for Business Folk

It’s a book that invites browsing. Open it to a random page and immerse yourself in one small business story. Riffle to a spot twenty pages earlier and taste another. It’s a book that can be enjoyed by someone on the go, someone only has time for, say, a ten minute skim before the next appointment. After a few chapters (sampled in non-linear fashion) I was reminded of Grimm’s Tales. The archetypes of the business world, in particular the entrepreneurial world, are practically the same. The plucky maiden, the resilient hero, the marrow-sucking ogre, the chastened warrior: they are present […]

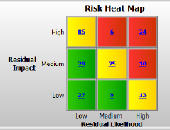

Measuring the ROI of GRC. Part 2: Solutions to “Absorb Regulatory Demands”

An unprecedented amount of new regulations “has led to risk assessment fatigue,” said John Kelly, Market Segment Manager in Business Analytics at IBM. He was the second of two speakers who addressed a GARP webinar audience on March 28, 2013 on the topic of the return on investment (ROI) on governance, risk assessment, and compliance (GRC). Most of the presentation referred to the study “Guidebook: Understanding the Financial Value of GRC Management” released in October 2012 by Nucleus Research that was talked about by Hyoun Park in the first part of the presentation. When it comes to regulation, there is […]

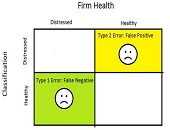

Measuring the ROI of GRC. Part 1: “Your Mileage May Vary”

When looking at the return on investment (ROI), “it’s not about getting the highest number—it’s what is most defensible,” said Hyoun Park, Principal Analyst at Nucleus Research. Park was speaking on March 28, 2013 to a webinar audience on the topic of how to quantitatively measure the ROI on governance, risk assessment, and compliance (GRC). The two-speaker panel, convened by the Global Association of Risk Professionals (GARP), based their remarks on a study released in October 2012 by Nucleus Research (cover shown here). The report states “this research was conducted in context of the usage of IBM OpenPages, a software […]

Global Challenges in Chemicals & Energy: Standardizing & Accelerating R&D

“The iPhone of experimental chemistry” standardizes and simplifies experimental chemistry in a paradigm-shifting manner, according to Michael Schneider, SVP of Chemspeed Technologies, and the holder and author of more than 30 publications and patents. He was delivering a presentation on March 19, 2013, through a webinar organized by Chemical & Engineering News (C&EN). “The iPhone of experimental chemistry” is based on a sleek desk-sized compartment that apportions chemicals in ”1-2-5” money analogously staggered (but in mmoles instead of cents) , ready-to-apply formats. It dramatically simplifies the experimental work in a multitude of “applications” in traditional experimental lab work and/or as […]

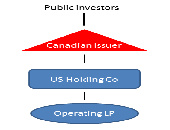

Foreign Asset Income Trusts

“Income trusts should be viewed as a story in capital markets innovation,” said Jon Northup of Goodmans LLP. He was speaking at a luncheon at the National Club in Toronto, sponsored by the Chartered Financial Analysts (CFA) Society Toronto on March 5, 2013. The introduction of SIFT (Specified Investment Flow-Through) rules by the Canadian government in October 2006, “effectively eliminated Canadian income trusts,” Northup said. There are two exceptions: (1) a trust that does not involve Canadian real estate, immovable or resource properties used in carrying on a business and (2) a trust that qualifies as a REIT (real estate […]

The Fed, Foreign Banks and Basel III: Part 3. Necessary Complexity?

As the US moves to adopt Basel III, there are regulatory initiatives that are expected to be implemented, said Peter Went, VP, Banking Risk Management Programs, GARP. The Basel Committee has several proposals that are issued for consultation and discussion, including ones that affect liquidity rules, the securitization framework, trading book review, and consistency of risk-weighted assets. Went was the second speaker at a webinar on February 14, 2013, organized by the Global Association of Risk Professionals (GARP) regarding regulatory reform of foreign banking operations (FBOs) in the United States and the implementation of the Basel III framework. (This continues […]

The Fed, Foreign Banks and Basel III: Part 2. Capital Concerns

“Some of the rules are in direct conflict,” said Peter Went, VP, Banking Risk Management Programs, GARP. He was the second speaker at a webinar presented on February 14, 2013 organized by the Global Association of Risk Professionals (GARP) regarding regulatory reform of foreign banking operations (FBOs) in the United States and the implementation of the Basel III framework. The “conflict” refers to rules in the Dodd-Frank Act versus the globally agreed Basel III Accord’s guidelines. Both regulatory attempts apply the G-20 principles on financial regulation (Pittsburgh 2009 summit). The US implementation of the Basel III framework differs from the […]