Financial Shenanigans: Forensic Accounting in Practice

There are ample opportunities for financial shenanigans in North American companies, according to Howard Schilit, founder of Schilit Forensics LLC and author of the classic Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports, first published in 1993 and now in its third edition. He led a mid-day seminar on characteristics of poor accounting practices at the CFA Society Toronto downtown offices on May 30, 2013. “Financial shenanigans are not necessarily illegal,” explained Schilit, but they are practices that “are not nice to perpetrate on someone” and could, if unchecked, slip into criminality. Given the extensive subject […]

Libor Fallout: Part 3. A Muted Valuation Effect

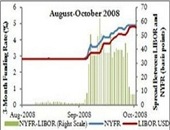

On December 20, 2012, the third presenter at the GARP webinar on the LIBOR scandal was Robert Maxim, director of Complex Asset Solutions at Duff & Phelps. He spoke about the valuation implications of incorrect LIBOR rates. The cash flow of many financial instruments is indexed to LIBOR, he said, for big companies as well as small, and even for individual consumers such as those holding private student loans. Maxim considered an interest rate swap example in which the floating leg is tied to LIBOR. The valuation is always computed on the difference between the fixed and floating leg. “The […]

Libor Fallout: Part 2. Whistling Past the Graveyard

On December 20, 2012, the second presenter at the GARP webinar on the LIBOR scandal was Cliff Rossi, Executive-in-Residence, Center for Financial Policy, University of Maryland. He described the risk implications arising from the Wheatley Review of LIBOR. Rossi noted that some market participants were “still feeling PTSD from the financial crisis of 2008”—and then they got hit with the LIBOR scandal. Rossi succinctly described what went wrong: Low volume in interbank lending in unsecured transactions created an over-reliance on “expert judgement” hence the rate was subject to manipulation. Part of the problem, Rossi said, is that LIBOR reporting was […]

Libor Fallout: Part 1. The Stomach Ache During the Heart Attack

The emerging scandal around the setting of LIBOR (the London Interbank Offered Rate) prompted GARP (the Global Association of Risk Professionals) to convene a panel of three experts to inform its members about the background and implications of the LIBOR fraud. On December 20, 2012, the first presenter at the GARP webinar was Amy Poster, Strategic Adviser at Iron Harbor Capital Management. She described the background and key facts. Calling it the “$800 trillion scandal,” Poster said that these events touched many derivatives markets, various consumer debt instruments such as credit card loans, and 100 percent of the sub-prime market. […]

Al Rosen: Latest Trends in Financial Deception

“Canada is changing. There’s a return to yield games” and manipulation of operating cash flow, said Al Rosen on October 25, 2012. He was addressing about 40 people at a CFA Society Toronto luncheon seminar on the topic “Latest Trends in Financial Deception.” Rosen is co-founder of Accountability Research Corporation (ARC), the investment research arm of Rosen & Associates Limited, a forensic accounting firm, and co-author of Swindlers: Cons & Cheats and How To Protect Your Investments From Them published by Madison Commerce Press in 2010. Rosen does not like the loose guidelines of the International Financial Reporting Standards (IFRS) in Canada. He paraphrased it thus: […]

Madoff Scandal: Three Books, Three Perspectives

The Madoff scandal has spawned a sub-genre of work. In the Toronto Public Library system, there are about twenty entries (books, e-books, DVDs) as of September 2012. It’s already a crowded arena. The books range from those written by victims (The Bag Lady Papers : The Priceless Experience Of Losing It All by Alexandra Penney, 2010) to those written by family (The End Of Normal : A Wife’s Anguish, A Widow’s New Life by Stephanie Madoff Mack, 2011) to those written by persons involved with hunting him down (No One Would Listen, by Harry Markopolos, 2010). Only one mistress has […]

No One Would Listen

Book Review of: No One Would Listen: A True Financial Thriller by Harry Markopolos 376 pp., including three Appendices, Note on Sources, and Index (Reprinted from The Analyst, December 2010 issue.) In December 2008, Bernard Madoff confessed to running the world’s largest Ponzi scheme. This real-life thriller by Harry Markopolos details his five unsuccessful attempts to get the SEC to put a stop to a$65-billion investment fraud. Harry Markopolos spoke to the Toronto CFA Society about his experiences in September 2010. Early in his Wall Street career as a portfolio manager, Markopolos heard about a fund with an extraordinarily consistent […]