Basel III Standardized: the Holistic Approach

“Banks need technology to help with Basel IIII compliance because moving from Basel I to Basel III is a quantum jump,” said Tom Kimner, Head of Americas Risk Practice at SAS Institute. He was the second of two panellists at a webinar held on September 16, 2014, organized by the Global Association of Risk Professionals to discuss the Basel III Standardized Approach for mid-tier banks. Kimner began by outlining five key issues to Basel III compliance: Data Structure and Validation – The data on credit exposures necessary for capital calculations needs to be cleaned and transformed. “An entire body of work […]

Basel III Standardized: Avoid the Showstopper

“If you can’t comply, it could be a showstopper,” said Henry Fields, Partner at Morrison & Foerster LLP, who was the first of two panellists at a webinar held on September 16, 2014, organized by the Global Association of Risk Professionals. The purpose of the webinar was to discuss the Basel III Standardized Approach for mid-tier banks (assets of over $500 million), and Fields began by giving an overview. The potential “showstopper” would be non-compliance with the new rules for risk weights for assets that are scheduled to come into effect January 1, 2015. “When the Fed issued the [new] […]

DFAST 2. Challenges of Modeling Credit Risk

There are multiple challenges to private firm commercial & industrial (C&I) risk management, according to Mehna Raissi, Director, Enterprise Risk Solutions at Moody’s Analytics. She was the second of two speakers at a GARP-sponsored webinar on September 9, 2014, to address the Dodd-Frank Act Stress Test (DFAST). Successful risk management depends on three things: the potential for error within standardized processes; ongoing monitoring of counterparty credit risk; and the efficacy of credit risk models. A very big challenge is data quality and availability. “What are the types of variables and factors needed?” Raissi asked. “How can we take into consideration […]

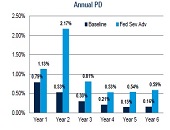

DFAST 1. Modeling Losses and Provisions Over Time

Although Dodd-Frank Act Stress Testing (DFAST) requirements may be the primary motivation for bringing stress testing to the forefront, they should not be the only reason a bank explores the components of loan loss forecasting under a stressed scenario, said Chris Henkel, Senior Director, Enterprise Risk Solutions at Moody’s Analytics. He was the first of two panelists at a webinar held on September 9, 2014, sponsored by the Global Association of Risk Professionals. An accurate forecast of charge-offs is crucial, Henkel said, so that a firm “can estimate what allowances should be and how large the provisions should be,” thereby […]