Aligning Risk Appetite. Part 2

To succeed, a company must take risk, but how can it keep a close enough watch to make sure the risks do not demolish its very existence? After Chris Mandel described the risk appetite framework in part 1 of this posting, Brenda Boultwood, Senior Vice President of Industry Solutions at MetricStream, took the floor to describe how technology can make it happen. She was the second of two presenters at the webinar “Aligning Risk Appetite with ERM Governance” sponsored by the Global Association of Risk Professionals on March 17, 2015. Boultwood said that risk assessment can be a “unifying call” […]

Aligning Risk Appetite. Part 1

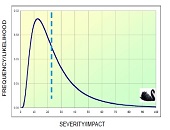

“How can you manage risk without understanding risk appetite?” asked Chris Mandel, SVP Strategic Solutions at Sedgwick, Inc. He was the first of two presenters at the webinar “Aligning Risk Appetite with ERM Governance” sponsored by the Global Association of Risk Professionals on March 17, 2015. “Some people ask why do I have to go through a bureaucratic exercise,” Mandel said, pointing out that there are real advantages to developing a risk appetite framework (RAF). Risk appetite management is expected more and more often by regulators, credit rating agencies, institutional investors, and internal auditors. “Missing the connection between risk and […]

Tailoring Risk Model to Investment Strategy

Due to the growing complexity of measuring financial risk, “risk has become a patchwork” of different models, said Phil Jacob, Senior Director at Axioma Risk Research. He was the sole presenter in a webinar about tailoring the right risk model to your investment strategy held on March 4, 2015, and sponsored by the Global Association of Risk Professionals (GARP). Jacob identified four inherent challenges. “There are operational issues stemming from existing rigid approaches,” leading to “difficulty in aggregating risk.” There is a lack of consistency in modeling portfolios, which can run the gamut from very simple proxies all the way […]