“Forests are the lungs of our land, purifying the air,” wrote Franklin D. Roosevelt. Looking at the economic side, what does the loss of forests mean to global markets?

“Deforestation is a risk to the supply chain,” said Gabriel Thoumi, Director Capital Markets at Climate Advisers. “It puts billions of dollars at risk.” He was the first of four presenters at the May 4, 2017, webinar sponsored by the Global Association of Risk Professionals.

He began with a summary of the activities of Chain Reaction Research, a group which has been actively assessing the sustainability of the supply chains of forestry-related commodities in Asia, Africa and Latin America. The group aims to “put a price on deforestation” by looking at specific markets such as those for palm oil, soy, cattle, timber, and cocoa.

Greenhouse gases accelerate global warming by trapping the sun’s energy. One-quarter of greenhouse gas emissions are estimated to occur due to agriculture and land use (such as tearing up forests to build cities or factories). In the tropical regions, 70 percent of deforestation occurs due to agriculture.

In 2016 the Carbon Disclosure Project (CDP) found that over 200 companies were involved in soy, palm oil, cattle, and timber, and had $906 billion in total revenue. Of this revenue, 24 percent depends on the commodities specifically linked to deforestation.

Thoumi, who was presenting from Jakarta, Indonesia, said that 6.1 million hectares—slightly smaller than the Republic of Ireland –of palm oil estate in that country was in danger of becoming a stranded asset. He defined stranded assets as those “assets that have suffered from unanticipated or premature write-downs, devaluations or conversion to liabilities.”

Fortunately, zero deforestation policies have become popular among environmentally aware investors. “Corporate leaders are committing to NDPE policies,” he said, referring to the acronym for “No Deforestation, no Peatland destruction, and no labour Exploitation.”

There’s great reputational advantage for corporations that choose to go the NDPE route, especially for those who are among the early adopters. “Laggards may lose equity valuation and market share,” Thoumi said. Credit rating agencies are warning unsustainable corporations of possible downgrades.

He described the application of 8 risk management tools:

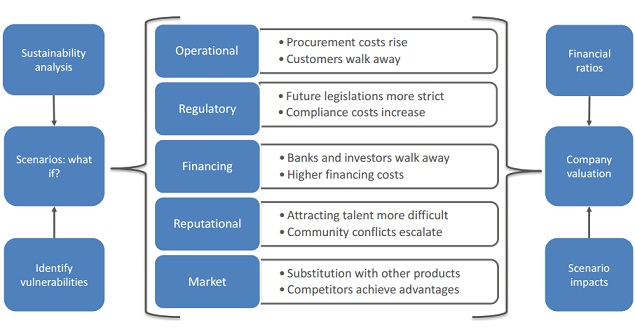

1. Describe risks by category – is it market risk, credit risk, liquidity risk, etc.? “Risk starts in operations and migrates to other locations,” Thoumi emphasized.

2. Generalized risk management – “Operational risks are direct,” he said. “All other risks are indirect.”

3. Scenario-based financial risk analysis – the economics team can put together a scenario for the stress test of heavy deforestation.

4. Corporate governance risk modeling – “Corporate risk appetite framework must include ‘material’ deforestation risks,” he noted. He cited an example of Felda, a organization that did not follow through on its high-minded NDPE policies.

5. Environment and social risk management at banks – for example, banks might choose to add environmental, social and corporate governance (ESG) covenants to loans.

6. Revenue-at-risk modeling using Monte Carlo analysis – Thoumi said that software available from Chain Reaction Research enables one to model losses in buyers’ revenues if the procurement policies are not upgraded to NDPE

7. Stranded assets modeling – this is currently being applied to the case of Indonesian palm oil. There are Supply side constraints from Government of Indonesia and Demand side constraints from corporations’ procurement policies.

8. Portfolio management techniques – last but not least, the portfolio could be filtered by country code (or by company) so that investment only occurs in areas where zero deforestation is followed.

In this way, using the common tools of financial risk management, an environmentally aware investor can tackle the problem of destruction of forests, one industry sector at a time.ª

Click here to read about the second speaker’s presentation.

Click here to view the GARP Webcast- Financial Impact of Supply Chain Risk: Zero Deforestation Case Study http://bit.ly/2ptk7Yq

The schema in this posting is from Dr. Thoumi’s slides. Permission pending.