“Some of the rules are in direct conflict,” said Peter Went, VP, Banking Risk Management Programs, GARP. He was the second speaker at a webinar presented on February 14, 2013 organized by the Global Association of Risk Professionals (GARP) regarding regulatory reform of foreign banking operations (FBOs) in the United States and the implementation of the Basel III framework.

The “conflict” refers to rules in the Dodd-Frank Act versus the globally agreed Basel III Accord’s guidelines. Both regulatory attempts apply the G-20 principles on financial regulation (Pittsburgh 2009 summit). The US implementation of the Basel III framework differs from the global version of Basel III that was agreed to December 2010, and there are some notable differences.

There have been delays in the US implementation of the Basel Accords previously – hence this is “not entirely unprecedented,” said Went. Delays are also occurring with the implementation of the Capital Requirements Directive IV (CRD IV) and the Capital Requirements Regulation (CRR) was also occurring in Europe. Apart from the inherent political conflicts within the EU, there are complex concerns affecting the regulation of the financial and banking markets there. Additionally, there are substantive concerns in the EU that relate to the Basel III liquidity rules and the implementation in the smaller EU countries with limited sovereign debt markets. But, Went remarked, the politically most charged debate concerns banker compensation – the relationship between base salary and bonuses.

In the US the major difference concerns the use of credit ratings for prudential purposes. The Dodd-Frank Act bans credit ratings, and there are very limited alternatives.

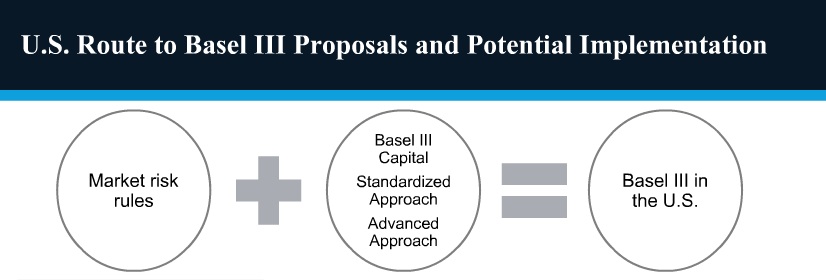

Went presented a schematic of the constituent pieces of “Basel III in the US” (see figure). It’s a combination of market risk rules, Basel III capital, both standardized and advanced approaches.

The new regulations considerably raise the complexity of risk-based capital calculations. [Ed. Note: See related postings on Basel III.] Most US institutions essentially move “from Basel I to Basel III,” said Went. This concern cuts across a wide swath of US community and smaller banks.

Concerns about the cost of Basel III implementation have been raised by the US banking industry, particularly the smaller community banks, said Went. There are multiple studies on the potential capital, business, and strategy impacts of Basel III implementation. In testimony before the House Banking Committee, representatives of the federal prudential agencies, the Federal Reserve, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation (FDIC) alluded to “thousands of comments” received. According to the agencies’ Senate testimony, the common themes were: proposed treatment of accumulated other comprehensive income (AOCI); residential mortgage exposures; and the complexity of rules for community banks versus large banks.

Went summarized one of the many impact analyses of Basel III on US institutions carried out by the FDIC. It is a dense tabulation based on information contained in the FDIC presentation to the House Banking Committee. [Ed. Note: See slides 52-53 of the presentation.] A grand total of 7,330 financial institutions have $1.445 trillion in risk-based capital (RBC). The estimated Basel III capital required is $1.426 trillion.

All of the “big six” banks (greater than $250 billion in assets) are well-capitalized. It is the small banks that are most likely to potentially have lower levels of capital. According to the FDIC study, there are a handful of banks of the 7,000-plus institutions that would not meet the Basel III capital requirements had the framework been implemented in the US by March 31, 2012. The largest problem meeting the Basel III regulatory capital thresholds relate to the countercyclical buffer, which bumps it up to 10.5 percent RBC. ª

Go to Part 3. ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=572054&s=1&k=C19F270D67A297DF58184B8D2B2DD6BC>