Heated Exchange

Climate-related natural disasters are increasing in frequency and severity and costs. Since climate change is not equal across countries, how does a country’s exchange rate respond to such shocks? Furthermore, is it possible to build an economic model to predict future changes? On April 6, 2023, Galina Hale, professor of economics at the University of California at Santa Cruz, delivered a webinar about the effect of climate change on exchange rates. This was part of the series of talks sponsored by the Federal Reserve Bank of San Francisco (FRBSF), titled the Virtual Seminar on Climate Economics. She reported results from […]

“Worse Than Silverfish”

Some authors go to great lengths to make their monographs up-to-the-moment. In this excerpt, the authors refer to a popular and critically acclaimed TV series. It’s a calculated risk. They use an obsession of the (fictional) characters—the money they are amassing—to tie into the very real phenomenon of hyperinflation. Today’s excerpt comes from page 103 of the book The Evolution of Money by David Orrell and Roman Chlupaty (Columbia University Press, 2016). “To visualize how hyperinflation can affect one’s personal savings, fans of the TV show Breaking Bad will recall the episode in season 5 in which it is shown […]

When Data Is Sparse. Part 2

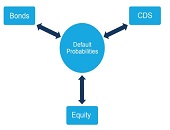

It’s difficult to model sovereign credit risk for emerging markets using structural models such as the Merton model because “calibration is always an issue,” said Rob Stamicar, Senior Director of Research in Multi-Asset Class Risk Management at Axioma, continuing a theme during the second half of his webinar on December 2, 2014. During the first half, he showed how the probability of default can be used as a common link among the asset classes of interest (bonds, swaps, and equities). In the second half, he focused more on sovereign credit risk. Calculation of sovereign risk could be done directly, “but […]

Risk Units & Risk Accounting

“In the absence of a standardized and universally accepted method of calculating exposure to risk, are accuracy, integrity and timeliness achievable?” asked Peter Hughes, Managing Director, Financial InterGroup (UK). He was the fourth of four panellists to present at the GARP webinar on risk data aggregation held July 22, 2014. Hughes was speaking with reference to the Basel Committee on Banking Supervision (BCBS) article 239, which spells out principles of accuracy, integrity, and timeliness for risk data. There’s a mixed bag of methods used to identify and quantify exposure to risk, Hughes noted. Quantitative modelling, accounting methods, key risk indicators, […]

Counterparty Credit Risk 2. The Good, the Bad, the Ugly, and the Unseen

“Data and its accuracy are key to making this work,” said Robert Scanlon, referring to counterparty credit risk. Scanlon is the former Group Chief Credit Officer of Standard Chartered Bank and current Principal, Scanlon Associates. As the second of three speakers at a GARP webinar on counterparty risk held on May 20, 2014, Scanlon spoke from years of experience with risk practices. First, the good part of calculating counterparty credit risk. Scanlon said there is plenty of data already, especially for consumer/retail transactions. “You can start with a steady state assumption and get more data as time goes on. Ask […]

Stress Testing, Part 2: Data, the River

A common theme throughout contemporary financial stress testing is “data, the risky river,” said David O’Connell, Senior Analyst, Aite Group, a financial services consulting group. He was the second of two speakers to address issues around data in stress testing in a webinar organized by GARP on January 28, 2014. The recent financial crisis has permanently altered the relationship between the central bank and all other financial institutions, said O’Connell. The central bank is now looking at them as potential customers for a line of credit, and thus must carry out due diligence including asking for proof that the financial […]

Europe: Is the worst over? Part I.

“The US had one financial crisis in 2008, but Europe has had two crises—2008 and 2011,” said Philippe Ithurbide, Global Head of Research, Analysis, and Strategy at Amundi Asset Management. He was addressing members of the CFA Society Toronto that had gathered in the TMX Group Centre in downtown Toronto on the evening of November 19, 2013 to hear an overview of European market trends. The first half of his talk was a comprehensive quantified description of the financial woes of the euro zone, followed by several proposed solutions and investments strategies in the second half. In the quarters since […]

China: Global Leader, Threat, or Both? Part 1. China and US

“Hide one’s brilliance, bide one’s time” seems the most fitting aphorism for China’s global strategy, said Daniel Wagner, CEO of Country Risk Solutions. During an hour-long webinar on October 22, 2013 organized by the Global Association of Risk Professionals, Wagner guided the audience through China’s evolving geopolitical position generally, as well as its relationships with US, Asia, and Africa. China is in the ascendant mode, said Wagner, citing the increasing use of the yuan as a reserve currency, as well as its rising military power. Regaining global dominance would be “like picking up where they left off,” he said, reminding […]

Modeling Sovereign Risk. Part 2: Quantification

“The Bloomberg sovereign risk model starts by dividing countries into two types,” said Rajan Singenellore, “reserve-currency countries and non-reserve currency countries. Everything else depends on that distinction.” Singenellore is Product Manager, Risk & Valuations at Bloomberg and was the second of two speakers to address a GARP webinar audience on September 12, 2013. A reserve-currency country is one whose currency is held in significant quantities by other governments as part of their foreign exchange reserves, such as the US and the Japan. There is a pressing need for quantification in the area of sovereign credit risk, he said, citing as […]