“This book is about a black swan event that turned out to be the largest restructuring in Canadian history,” the moderator Marlene Puffer said as she welcomed dozens of people to a breakfast book launch, held at the Rotman School of Management, University of Toronto on November 9, 2016. In financial markets, the year 2007-8 was a precarious time—“things could have gone either way,” she noted. Ultimately, there was a happy ending: the value of billions of dollars of asset-backed commercial paper (ABCP) in Canada was preserved and most investors were made whole.

“This is the book that tells the story,” said Puffer and she held up the copy of Back from the Brink: Lessons from the Canadian Asset-Backed Commercial Paper Crisis.

The launch featured a panel discussion, with three of the four co-authors—Caroline Cakebread, Poonam Puri, and Paul Halpern—being interviewed by Puffer, who is partner at Alignvest Investment Management and founder of Twist Financial.

From the outset, the panellists were unanimous in their praise: the happy ending of the ABCP story was largely due to the keen negotiating skills of the late Purdy Crawford.

In August 2007, the $32 billion dollar third-party ABCP market froze. The ABCP at the heart of the crisis was typically mortgages and consumer loans, 30 to 90 days duration. The paper contained credit default swaps (CDS) and collateralized debt obligations (CDOs). “Third party” meant that this paper was not backed by any of Canada’s “Big Five” banks. Over the next few days, and then months, people worked hard to return liquidity to this market. The delicate restructuring occurred during an incredibly volatile period, the financial crisis of 2008.

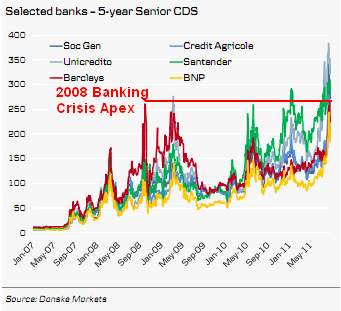

Paul Halpern, Professor Emeritus of Finance at Rotman, said that there was “lots of colour in the story.” The first time around, Crawford thought he had a deal but the restructured ABCP notes were intended to trade in a liquid market—and at that point everything began freezing up again. CDS spreads were starting to rise (see graph); Lehman Brothers went bankrupt; and the group of ABCP investors known as the Pan-Canadian Investment Committee (PCIC) got cold feet. The hedge funds wanted out, and had to eventually get out via auction. Near the end, Crawford was negotiating daily to keep everyone in line.

Crawford knew what was on the line. Without an agreement, all parties were in danger of walking away from a $32 billion restructuring.

“The entire deal was successful because of [his] overtures,” said Caroline Cakebread, editor of Canadian Investment Review and a Shakespearean scholar. She said what interested her most in writing about the near-fiasco was: how did people work together to avoid a massive financial crisis? “It was really challenging to get people to talk,” she said. “What really struck me was how fast it all happened. It could have been very severe.”

Fixed income products are not normally linked with taint in the markets, but at that time, rumours circulated. Of the total assets, only 4 percent was subprime—although that fact was not known at the time. Marlene Puffer noted the lack of transparency was so great, “a little mouse of 4 percent subprime assets scared people.”

Paul Halpern spoke about the role of leverage. “The structure itself was flawed. With short term notes, liquidity agreements were supposed to protect. What they overlooked is that the assets provider and the liquidity provider were the same entity.”

Puffer commented on the role of credit ratings agencies. “Standard & Poors and Moodys refused to rate the ABCP, but DBRS (formerly Dominion Bond Rating Service) did agree to rate. The mark-to-market triggers were a problem, because the response was often a collateral call. Leverage meant that small changes had a big impact on collateral.

Another dimension to the ABCP crisis was the type of investor involved. Inadvertently, some ordinary unsophisticated investors had been dragged in. People who were temporarily in charge of a large amount of capital, for example, through sale of a business, were convinced to buy ABCP by brokers who blithely reassured them it was a safe place to temporarily store money.

The retail investors comprised $138 million of the third-party ABCP, and of these, CanAccord had sold the largest amount. “Retail investors were often the most vulnerable,” said Cakebread. “It was sold to them as a GIC, and they found themselves with no money, no recourse, and nowhere to turn.”

This led to “one of the most interesting uses of social media,” she said. Brian Hunter, an engineer in Calgary, developed a Facebook group “with enough investor clout to knock on the boardroom door and say, ‘you must recognize our vote.’” CanAccord could not afford to make whole all its affected retail investors, and their voices grew loud loud and angry.

Co-author Poonam Puri said that retail investors had an unexpectedly large effect. The Companies’ Creditors Arrangement Act (CCAA) allowed for the reorganization of debt rather than a fire sale of assets—but it needed a supermajority of investors (both in numbers and dollars). In a compliance sweep, Investment Industry Regulatory Organization of Canada (IIROC) found there was poor understanding of know-your-client rules.

Halpern said due diligence was not done because it was costly to carry out the necessary stress testing and transparency was lacking. “They did not know what was in the paper and they couldn’t find out.” After restructuring, the Ontario Securities Commission (OSC) went to the dealers and was able to get $60 million returned to investors.

Puri noted the OSC sweep highlighted failings and now there would be greater transparency with more disclosures. “Monthly reporting is required. Institutional investors will do due diligence.”

Halpern characterized the ABCP story of the crisis as “a series of deals, lost 18 times.” Cakebread elaborated: “each deal had to be constantly re-greased, restructured, and reworked.”

Overall, Crawford’s deal stopped Canada from having a financial crisis. By January 2017, the final segments of the restructured deal will draw to a close.

The panel discussion was followed by a lively Q-and-A from the audience. At the very end of the launch, Halpern predicted: “for those who lived through the crisis … you will shake when you read about what could have happened.” ª

Click here to read a review of Back from the Brink in The Analyst, March 2017.