With the Covid-19 pandemic still posing challenges to the economy and national health, many financial institutions are making changes to their recruiting mandates. How can they continue to attract the best candidates? How can they mitigate the restrictions of the pandemic when “in person” visits are at the heart of recruitment?

“Recruitment is the proverbial case of finding the needle in a haystack,” said Bill Vlaad, President and CEO, Vlaad and Company. “Our job is not to go through hay, but to find the needle.”

He was speaking at a webinar on December 17, 2020. The CFA Society Toronto convened three experts in a panel discussion on the current employment picture and the long-term impact of the pandemic on the job market. The webinar, including a Q&A session, was moderated by Craig Geoffrey, CFA, Assistant Professor at Rotman School of Management.

“Hiring mandates are at or near record highs,” said Vlaad. “No matter whether the market is going up or down, the fact is transactions are constantly being made.” In terms of the near future, he predicted “a frothy January because of a dramatic change in compensation philosophy.”

Vlaad advises job searchers to consider three aspects of how they are viewed by prospective employers: their education and previous experience; how they are represented professionally on social media; and how they interview and get to meet the team.

“Banks and insurance companies have a huge desire for safety during the pandemic,” said Corey Shaw, AVP, Talent Acquisition, Canada Life. He has observed an “accelerated hiring demand for positions such as financial advisors.” Canada Life is “on a journey to become the trusted advisor.” Across the industry sectors, he noted a “tremendous unevenness in the economy.” Companies are learning different ways to engage and do business.

The hiring environment depends on the business line, said Matthew Laing, Senior Recruitment Consultant, Global Banking & Markets, Bank of Nova Scotia. The tech sector has an obvious benefit, he said, and the chief question is, “how do we nurture internal talent and reskill it?”

“Credential demand is becoming increasingly important,” Shaw said. With greater wealth transfer from the boomer generation, the younger generational cohorts are more informed. He pointed to a constant demand for accuracy, clarity, and trust. “How do you create franchisable, sustainable relationships?” He said he is “seeing more movement between start-ups and large corporations.” For his company, “if we see someone with the [relevant] experience, we are interested.”

Laing said there is greater sensitivity to issues of social justice and having different backgrounds. “We need more data points for finding top talent from different backgrounds.”

Vlaad said that firms are starting to recognize the equity built up in their people: “’Hungry’ staff have had to learn a fast-changing industry.” He sees two skill sets coming to the fore: relationship management and problem solving.

“Cold calls” are more challenging now than ever before, “so we are looking for people with deep connections,” he said.

“Clients don’t want to hear your history, they want to hear about how you will solve their problem,” Vlaad emphasized. “Use your history to tell us why you are qualified to solve a problem.”

The moderator Craig Geoffrey asked whether the widespread working from home (WFH) was helping or hindering recruitment.

Laing said WFH had broken down some barriers in terms of allocating time-blocks for work (it’s easier for traders to start work in the very early morning) and also hiring persons in different time zones.

Finance in Canada has been very strong in the golden horseshoe region and the corridor extending from Toronto to London, Ontario. Shaw said the remote working environment has had a profound impact. “With the new mindset, the geocentric locations are less important.” He cited the example of a team leader who has asked him to recruit one person from each province, to ensure diversity of national perspective. That is possible to do in the remote working model, but not in the show-up-in-the-office model.

Furthermore, artificial intelligence (AI) and machine learning (ML) are being applied to recruitment. The algorithms “might show talent is in Poland or Brazil,” Shaw said. “Everything you’re doing online will track you and [the algorithms will] find you and bring you” to the attention of talent recruiters. “For example, Sunlife will reach out to a person in Nanaimo whose digital footprint matches what [the prospective employer] wants.”

Social and Online

“When you’re social and online,” Shaw said, “you need to be authentic and continuous.” Recruiters look for the right kind of profile, whether someone asks questions and contributes to a forum “not just once every six months but on a continual basis.”

Vlaad agreed. “You can’t fake your way into networking.” He contrasted the old way of one-stop on-campus recruitment visits with the new way of online monitoring. The old way meant universities that were hard to travel to were routinely ignored. Now, employers are not restricted to nearby universities.

Laing encouraged new job seekers to embrace “the long-term networking play.” A candidate “might not get the dream job today, but you will strengthen connections.” He cited an example of an intern who was recently hired despite the lack of a résumé. The employer “just went with LinkedIn and a psychological profile.”

AI is absorbing repeatable-process activities, Shaw said, “so those skills are less in demand. [Employers] are looking for people with a sense of purpose. They want people attracted to the work… who have the right mindset for problem solving.”

Vlaad said, “the most important skill is EQ, not IQ,” referring to a distinction between emotional quotient and intelligence quotient as a shorthand for people skills vs technical skills. “Execution skills can be commoditized.”

Laing encouraged job seekers to showcase natural curiosity and good attitude.

“How do you deal with ambiguity and competing demands?” Shaw said. “I look for those who are resilient and can flourish in challenging environments.” He said that psychometrics are often used in recruiting. A candidate can, and should, ask the organization if s/he can have access to their outcomes. “It does give you insight.”

“Companies are going through their own changes,” Vlaad said. “There will be conflict between what systems provide and hiring managers’ ability to digest the information.” There are many ways to search a haystack for a needle, and not all of them are efficient. ♠️

The webinar presentation was recorded by CFA Society Toronto.

The third graphic is from Moneycrashers.com website. Permission pending.

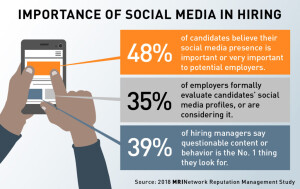

The social media graphic was not used in the presentation and is included here purely for information. Click here to visit the toggl.com posting it appeared in. Permission pending.