California Perspective

Imagine feeling shut out from important decisions in your community. Imagine feeling you were always the last choice when it came to hiring for the good jobs. If social studies showed this was always due to systemic bias, wouldn’t you want to work for change—if not for yourself, at least for the generation to come? This is the motivation behind the movement for diversity, equity, and inclusion (DEI). What are the fundamental principles to accelerate change around DEI? Can financial institutions adapt to DEI—and can their regulatory body, CFA Institute, lead the way? To showcase thriving financial institutions that have […]

E-Growth in Emerging Markets

What is happening in emerging markets? Are there areas where an informed investor can make a profit? What are the pitfalls to avoid? On November 22, 2022, the CFA Society of Toronto hosted a virtual webinar, “Rethinking Emerging Markets: The Case for Growth & How to Capture It.” The speaker was Kevin T. Carter, the founder and Chief Investment Officer of EMQQ Global. Carter began by providing his background. “I pray toward Omaha,” he quipped, because he considers himself an active “value” investor first and foremost, along the lines of “the oracle of Omaha,” Warren Buffett. Carter has collaborated with […]

Towards a Common Standard

Investors around the world are demanding consistent, high-quality reporting of environmental, social, and governance (ESG) data. Is there any global governing body for financial reporting that is up to the task? How can an organization ensure that sustainability reporting is comparable, consistent, and comprehensive? Furthermore, is the input from financial professionals welcomed? The answer, apparently, is “yes” on all three counts. On June 21, 2022, Josina Kamerling, member of the Value Reporting Foundation and the CFA Institute, welcomed an audience of hundreds to a webinar titled “Endgame: Will the ISSB become the comprehensive global baseline for sustainability disclosure?” She introduced the representative […]

Carbon, Cargo, Covid

As we slide into summer 2022, what are the big factors affecting the markets? Carbon, cargo, Covid. Governments and companies are starting to address the excessive carbon dioxide that is causing climate change. Interruptions of the supply chain, heavily dependent on cargo ships, continue to worsen operational risk. Meanwhile, the global economy is still dealing with the Covid-19 pandemic. On May 2, 2022, Derek Walter, head of the Institutional Asset Management Committee at the CFA Society Toronto, moderated two panelists during a webinar to discuss the underlying drivers of market changes. “We need to separate the short-term from the long-term […]

But What About Inflation?

Now that the worst of the Covid pandemic appears to be over for North America, inflation has kicked in and investors everywhere are on guard. Is the inflationary trend here for the long term? What, really, lies at the root of this particular instance of inflation? Moreover, what is the best hedge against inflation? On April 4, 2022, James Montier, a member of the Asset Allocation Committee of the CFA Society of Toronto, gave a one-hour webinar on “Hedging Inflationary Risk.” He is the author of three market-leading books: Behavioral Finance: Insights into Irrational Minds and Markets, Behavioral Investing: A […]

Ethical Decision Making

Question 1. Do you think that one’s belief system triggers one’s actions? Or does one act and then justify one’s actions by changing one’s beliefs? Question 2. Is an effective leader one who adheres to a constant belief? Or is the effective leader one who adheres to “situational ethics”? These are two dilemmas that were explored in more depth on February 8, 2022, when Kevin Veenstra, Associate Professor at De Groote Business School at McMaster University, presented a virtual workshop on ethical decision making to members of the CFA Society Toronto. Veenstra’s research focuses on personality and unconscious motives and […]

The future of active management

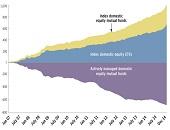

“Active portfolio management is futile,” say some who watch the progression of the financial industry. “Active managers only randomly outperform the stock market as a whole.” Is this true, or have the rumours of its demise been greatly exaggerated? On June 10, 2021, Philip Young, CFA, welcomed a webinar audience on behalf of the CFA Society of Toronto to consider this very question as they listened to Ronald Kahn, Managing Director, and Global Head of Systematic Equity Research at Blackrock, the world’s largest asset manager. He recently co-authored the book Advances in Active Portfolio Management: New Developments in Quantitative Investing. […]

Death of Fundamental Analysis?

Have you been following the market frenzy around stocks for GameStop, AMC and Bed Bath & Beyond? Or the news on Wall Street Bets and Robinhood? How disruptive are these events for traditional valuation methods? What new factors must be considered when investing and allocating capital? Recent shifts in market dynamics have altered the perception of capital markets in meaningful ways. On April 8, 2021, the Corporate Finance Committee of the CFA Society of Toronto convened a panel of experts to discuss the reasons market valuations are so out of synch with fundamental analysis. Moderator Stephen Foerster, Professor of Finance […]

Who’s Minding the Bots?

Artificial intelligence (AI) is being implemented in nearly all sectors of the economy at an increasing rate. A 2019 survey by Gartner showed that 37 percent of organizations had already implemented AI in some form. When it comes to integrating AI into your company, what are the risks? What are the opportunities? On March 12, 2021, the Industry Relations and Corporate Governance Committee of the CFA Society Toronto convened a panel of experts to look at how effectively a company’s corporate governance can provide proper oversight and avoid mistakes. In other words, “who and how we will mind the bots.” […]

The Data Factory

Annual global spending on alternative data, estimated at US$7 billion in 2020, provides insights to all kinds of industry sectors. How can financial analysts participate in this burgeoning field? On March 3, 2021, the Professional Development Committee at CFA Society Toronto held a second panel discussion on alternative data. Alexandra Zvarich, representing the committee, asked the panellists about the role of alternative data especially in finance, where investors are constantly searching for new sources of alpha. “Alternative data is not new to finance,” said Abraham Thomas, Chief Data Officer and co-founder of alternative data firm Quandl. The firm provides financial, […]