Moving to a sustainable future on a global scale is challenging. The United Nations Environment Program (UNEP) was founded to encourage member nations to develop sustainability agendas. Through their Financial Initiative (UNEPFI), the UN plans to harness the power of the financial system to this end as well.

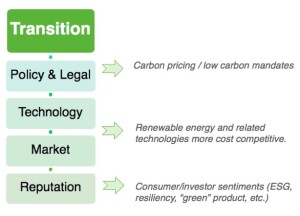

How can banks, insurers, and investors help accelerate sustainable development? How can they manage transition risk, namely the collection of non-physical risks associated with the transition to environmental sustainability? Does artificial intelligence (AI) have any role to play?

In 2015, the Financial Stability Board created the Task Force on Climate Related Financial Disclosures (TCFD) to provide information to investors about what companies are doing to mitigate the risks of climate change, as well as to provide transparency about the way in which they are governed.

The financial system depends on financial models: the tools and analytic systems to estimate climate risk that enable it to plan for different scenarios. David Carlin, Programme Lead of TCFD at the UNEP Finance Initiative, wants to keep risk managers informed, so on a quarterly basis he updates the database covering the range of tools and providers.

Carlin was the guest speaker in a podcast on May 2, 2024, sponsored by the Global Association of Risk Professionals (GARP). He was interviewed by Jo Paisley, President, GARP Risk Institute.

Last year companies wanted general answers, such as how to pick analytics providers for modelling various climate scenarios, but this year, the focus is on the emergence of AI and other big-data approaches. Carlin urged caution about jumping to AI too quickly. At this stage, when AI is poorly understood, it could create more volatility instead of helping solve problems. “Herd mentality,” he said, “could supercharge the effects.”

He compared this phase to the early, first-level understanding of climate change, which deepened over time to include second-level effects, such as drought and wildfire.

Paisley pointed to research at Oxford using natural language processing, a case where “AI is good enough to spot greenwashing,” the act of making false statements about the environmental benefits of a company’s practices.

Carlin said that nowadays environmental disclosures are usually complete (an improvement over past gaps in reporting) and this permits potential investors to see where sustainability is lacking.

Humans must be involved in the assessment of environmental risks, he emphasized. He compared AI uptake to automation in cars. “We are not at the level of driverless cars—we are at the level of cruise control. Cruise control is great until you have to turn. The human in the loop is very important.”

Although AI can generate and evaluate, he said it is “not terribly good at drawing conclusions.” Another problem is that companies can learn to game the system.

Paisley asked if ESG ratings still made sense. “Tesla is high ESG or low ESG,” she pointed out, depending on whether the ESG rating gives more weight to producing EV cars, a high-sustainability product, or governance issues, which the company struggles with.

“We’re stepping into incoherence.” Carlin agreed there was a lack of correspondence between ESG ratings. “It’s become a junk drawer of topics” with some attributes for ESG being orthogonal to each other.

GARP has recently published guidelines on nature risk, which Paisley defined as the loss of the natural world, such as topsoil erosion, loss of mangroves, and desertification. “Nature is at a tipping point on the order of years, not decades.”

Carlin said UNEP-FI was working to correct the negative trend in nature risk. They are running mini-pilots on nature-risk interactions. “We plan to look at implementing a LEAP approach to assessment in financial disclosures” to get companies to consider what nature means to them. (The acronym stands for Learning, Evaluation and Planning.)

“How do financial disclosures drive the changes we need to see?” Paisley asked.

Carlin described the theory of change. “Markets are undervaluing nature and the environment.” The world is in “massive energy system volatility.” The analysts who are underwriting deals are working in a “green fog” of disagreement over environmental rating because financial disclosures are not all that useful yet. “We’re still in the demo phase.”

Soon, the Intergovernmental Panel on Climate Change (IPCC), an intergovernmental body of the United Nations, is expected to table a report on the progress toward the target of 1.5 degree warming. Carlin expressed concern about the modelling. “You can’t use a single scenario to answer all the questions.”

Paisley added that the Ukraine crisis and other sociopolitical issues were not included.

The member nations will most likely exceed the 1.5-degree target, Carlin said, but we mustn’t give up. It’s also a question of how rapidly we are mitigating the situation. “We need to be aware of transition risks. Every bit of a degree matters.” ♠️

Click here to see the list of GARP podcasts on risk.

Click here to listen to this podcast, an interview with David Carlin on May 2, 2024.

To read recent concise summaries of key ESG reports, visit David Carlin’s LinkedIn page - https://www.linkedin.com/in/david-carlin7/

Click here to visit the UNEPFI homepage.

Click here to access UNEPFI’s 2024 Climate Risk Landscape Report.

The cruise control cartoon is from the Instagram page, thecrowbarcomics.