Impact of Basel III on Capital Instruments. Part 2: Football vs. Soccer

On August 16, 2012, speaking at a webinar hosted by the Global Association of Risk Professionals (GARP), three panellists gave a perspective on the changes Basel III would wreak on capital instruments. Click here for Part 1. The second speaker, April Frazer, Director of Client Solutions Group at Wells Fargo, gave an overview of the impact of the US Basel III proposal on market dynamics. Due to regulatory limitations that she is subject to as a member of a financial institution, her talk is not reported on here. Steve Sahara, Global Head of DCM Solutions and Hybrid Capital, Crédit Agricole […]

Impact of Basel III on Capital Instruments. Part 1: Ramp-up in Capital

On August 16, 2012, three panellists gave a perspective on the changes Basel III would wreak on capital instruments. It was a highly detailed talk, delivered at high speed, with many qualifications made to the main points, but the sponsoring organization GARP has done a tremendous service to its membership by gathering together these experts. There are some excellent summary slides (link below). This two-part posting showcases the top messages from the three experts, Dwight Smith, April Frazer, and Steve Sahara. In June 2012, three US regulatory bodies (the OCC, the Federal Reserve Board, and the FDIC) proposed three sets of […]

US Implementation of Basel III. Part 2: The GPS for the Journey

On July 24, 2012, Peter Went, VP Banking Risk Management Programs at GARP, summarized the changing landscape of Basel III from a US perspective. First he outlined the deadlines and proposed changes; Part 1 of this posting covers these for the standardized approach. Financial institutions adhering to the advanced approach, Went said, must follow the Basel III counterparty credit risk rules. In some cases, correlations between asset values must be increased. A distinction will be made between securitization and resecuritization. [Ed. Note: To this, we say, “high time.” See, for example, Hull & White’s award-winning article in Financial Analysts Journal, […]

US Implementation of Basel III. Part 1: A Long and Winding Journey

The long and winding US route to Basel implementation has been more difficult and circuitous than the route for European banks. Peter Went, VP Banking Risk Management Programs at GARP, delivered a webinar update on the Basel III leg of the journey on July 24, 2012. First, Went summarized the deadlines. Several sequential proposals have been issued by the US prudential agencies: the OCC, FRB, and the FDIC, with an expected implementation date beginning January 1, 2013, and a series of milestones thereafter. [Note: by mid-December 2012, the implementation dates for most of the Basel III proposals have been delayed […]

Risk-Based Capital Requirements under Basel III: Part 2. The More Capital, the More Stability

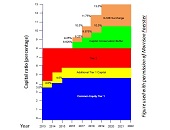

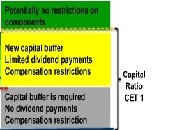

On July 17, 2012 Peter Went, VP Banking Risk Management Program at the Global Association of Risk Professionals (GARP), addressed a webinar audience on the significant changes to capital requirements under the new Basel III rules, as was reported in the Part 1 posting. According to the survey of the Basel Committee Basel III Monitoring Exercise, many banks have embarked on aggressive campaigns to raise capital. In addition to increasing existing capital requirements, Basel III proposes two new charges: the capital conservation buffer, which may require banks to maintain an additional 2.5 percent, and the countercyclical buffer (shown in the […]

Risk-Based Capital Requirements under Basel III. Part 1: The Trillion-Dollar Tweak

The friendly and ever-so-precise tones of Peter Went, VP Banking Risk Management Program at the Global Association of Risk Professionals (GARP), have been moderating a cavalcade of panellists over the past couple years. When the chance arose to attend his solo webinar on July 17, 2012, we leapt at the opportunity. Went, co-author of five books on financial risk management, spoke about risk-based capital requirements and how the Basel III Accord redefines and increases the quality and quantity of these requirements. His presentation was divided into three parts: capital under Basel III, US implementation of Basel III capital rules, and […]

Ethics and Risk Management: Part 3

A panel of four specialists convened to discuss various aspects of ethics in risk management in a GARP-sponsored webinar on June 21, 2012. (Click for Part 1 and Part 2 of this summary.) The fourth and final speaker was Roger Miles, Director, NudgeGlobal. He spoke on risk control lessons learned from the banking crisis. In the financial sector, he said, “UK-enforced self-regulation was a good idea in theory.” A bank can realize an ever-increasing profit from a new, complex product, but the regulator has limited resources, therefore, there is an essential asymmetry of information that cannot be overcome. However, in […]

Ethics and Risk Management: Part 2

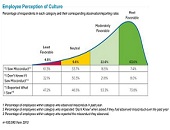

A panel of four specialists convened to discuss various aspects of ethics and risk management in a GARP-sponsored webinar on June 21, 2012. Part I of this blog posting summarizes comments by Peter Went and Hans Helbekkmo. The third speaker was Dan Currell, Executive Director, Corporate Executive Board (CEB). He presented empirical findings from the CEB on-line survey that asked essentially two questions: “Have you seen misconduct? And if so, what was it?” I have mixed feelings when I listen to survey results. I listen as someone who craves a snapshot of current opinion; I also listen as someone who […]

Ethics and Risk Management: Part I

Risk professionals are called upon to monitor, measure, and manage risk throughout corporations. It’s all too easy to get caught in the thicket of regulations, methodology, and topical issues. Thank heavens that that, every once in a while, the Global Association of Risk Professionals (GARP) encourages its membership to look at the bigger picture: ethics. A panel of four specialists convened to discuss various aspects of ethics in risk management in a webinar on June 21, 2012. When it comes to doing the right thing, it is no longer just a good conscience that should motivate someone to report unethical […]

Using Informatics to Keep Up with the Data Deluge

If you’re feeling a tad overwhelmed by the rate of publications appearing lately, spare a little sympathy for those who use PubMed, a database of references and abstracts on life sciences and biomedical topics. In 1980, articles were being added at a rate of 250,000 per year; by 2011 that rate had quadrupled to one million per year—flooding in from 39,000 different refereed journals. The problem is, only ten or twenty of these articles might bear relevance to the work an individual researcher is carrying out. The question becomes: how does one efficiently find those ten or twenty papers? In […]