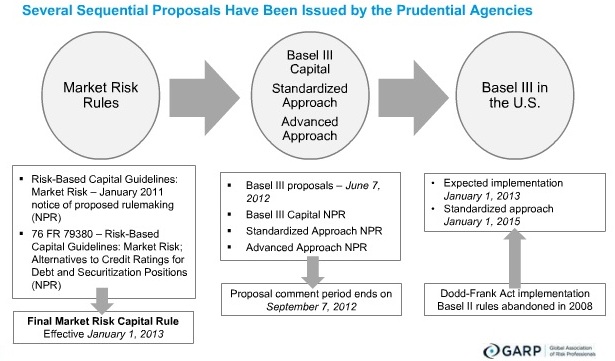

On July 24, 2012, Peter Went, VP Banking Risk Management Programs at GARP, summarized the changing landscape of Basel III from a US perspective. First he outlined the deadlines and proposed changes; Part 1 of this posting covers these for the standardized approach.

Financial institutions adhering to the advanced approach, Went said, must follow the Basel III counterparty credit risk rules. In some cases, correlations between asset values must be increased. A distinction will be made between securitization and resecuritization. [Ed. Note: To this, we say, “high time.” See, for example, Hull & White’s award-winning article in Financial Analysts Journal, Sept/Oct 2010 which shows the pitfalls of resecuritization.]

A core challenge in the market risk capital rules, Went said, is accounting for the direct regulatory impact of credit ratings (Section 939A of the Dodd-Frank legislation). That rule prohibits the use of credit ratings provided by certain rating agencies for a host of different reasons, including the determination of regulatory capital requirements. Hence, the Dodd-Frank Act directly impacts the way the US has chosen to adopt Basel III.

Risk-based capital guidelines for sovereign debt are debatable. The OECD, which publishes Country Risk Classifications, sets the risk weights for debt denominated in USD and in EUR at zero. These ratings look at convertibility risk and not at credit or migration risk. Went asked the audience whether it was in fact realistic to view Greek sovereign debt on par with the US.

Additional standards will be imposed on securitization positions. A simplified form of the Supervisory Formula Approach (SFA) will be required.

Went summarized the US-based implementation of Basel III. It incorporates most of the Basel III proposals (common equity Tier 1 and higher minimum capital ratios). It contains an improved (more sensitive and more sensible) risk-weighting approach under the Standardized Approach compared with the Basel I approach. Additionally, the proposal has a broader spectrum and the risk weights . Now, it is a matter of time and care in phasing in the regulatory changes.

Step by step, financial risk management at these institutions is improving. We are indebted to the expert analysis by commentators such as Peter Went who provide a valuable function in reminding us of the next stages of the journey. This is a complex journey – and the complexity is increasing. The question, of course, remains: is the best solution to complexity more complexity? We are counting on the GPS of the risk management world, as it were, to help navigate the complexity. ª

The webinar presentation slides can be found at: https://event.on24.com/eventRegistration/EventLobbyServlet?target=registration.jsp&eventid=470801&sessionid=1&key=736C8531E47F8A1151998EC457A8E99C&sourcepage=register