“If you can’t comply, it could be a showstopper,” said Henry Fields, Partner at Morrison & Foerster LLP, who was the first of two panellists at a webinar held on September 16, 2014, organized by the Global Association of Risk Professionals. The purpose of the webinar was to discuss the Basel III Standardized Approach for mid-tier banks (assets of over $500 million), and Fields began by giving an overview.

The potential “showstopper” would be non-compliance with the new rules for risk weights for assets that are scheduled to come into effect January 1, 2015. “When the Fed issued the [new] rules, it made light of the effect” it would have on mid-tier banks, saying that most banks would already be in compliance. However, the Fed “did not account for the complexity” of the rules, said Fields, and the effort it would take to ascertain whether a bank was in compliance or not. There are over 1,000 mid-tier US banks.

The new rules are scarcely dry on the paper. “Just last week the last rule for the liquidity coverage ratio was passed,” said Fields, and that rule will take effect January 1, 2015. Some banks are still rushing to comply.

The Basel III Act brings in some major changes to capital rules and makes some capital floors higher than they were previously. There are changes to the components of capital, and to the capital conversion ratio, as well.

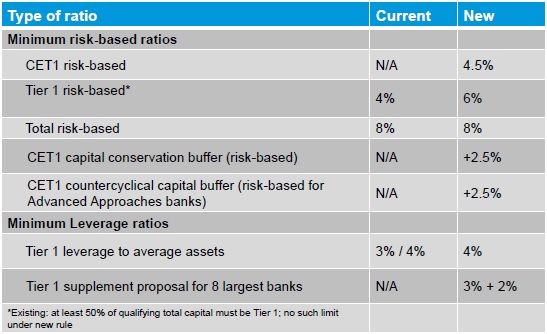

Fields summarized the three minimum risk-based capital ratios: a common equity Tier 1 (CET1) capital ratio of 4.5 percent, which is new; a Tier 1 capital ratio of 6 percent, which was previously set to 4 percent; and total capital ratio of 8 percent, which remains the same.

The new act means changes to the leverage ratio (details specified in the presentation), and new Supplemental Leverage Ratios which will affect the largest eight US banks.

The Capital Conservation Buffer (CCB) is the ratio of CET1 capital to risk-based assets, and its minimum will be set at 2.5 percent. It could be “a significant impediment to making distributions” and thus “affect the stock price” of banks that fail to meet the minimum set by Basel III.

Fields dealt briefly with the Countercyclical Capital Buffer (CCyB), which is a capital buffer of up to 2.5 percent of CET1 capital to risk-weighted assets. The CCyB could be levied if sufficient macro-economic indicators suggest a downward trend (countercyclical ) following “a joint determination by federal banking agencies.”

Fields’s presentation contained a summary table of capital ratios (reproduced here).

The components of capital include the Accumulated Other Comprehensive Income (AOCI). Fields cautioned this one-time only number “can be volatile” and thus, “banks should be looking hard at [the AOCI] election.”

He stressed the necessity of having “a significantly detailed tracking system” so that all categories of capital could be looked at. Deductions from Tier 1 / Tier 2, such as for minority interest, are “complicated” and also would benefit from software tracking.

“What will be difficult for mid-tier banks is the 11 broad asset classes including new categories” for such assets as residential

mortgages, commercial real estate lending, corporate exposures, and off-balance sheet (OBS) exposures, to name a few. For OBS exposures, “the biggest change is the credit conversion factor.” It’s set at 20 to 100 percent unless the commitment can be cancelled at the discretion of the bank. The 11 asset classes are demarcated in the appendix to Fields’s presentation [see link below].

Unsettled transactions (not settled within the prescribed period), and unsecured past-due loans, are risk-weighted at 150 percent.

Credit risk mitigants are several in number. “It’s a rational scheme but highly complex… it reflects the Basel II standardized approach,” said Fields. “It will require a significant amount of internal work to determine how to comply.”

Given the ambitious time-frame, banks must act soon to determine how all these risk-weight and mitigant changes will affect their investment policies in the years ahead.ª

Click here to view the webinar presentation this is based on. Henry Fields’s section is contained in slides 4 to 33. The eleven asset classes are explained in the appendix (slides 43 to 58).