Flood Economics

When it comes to natural disasters such as flooding, does it make more economic sense to control the flood? Or to sit back, suffer the consequences, and count on insurance? Climate change leads to more frequent and more intense flooding. As these risks intensify, public funds will often be used to protect communities. Recent work done by economists estimates the amount and distribution of benefits from a major form of public flood risk adaptation, flood control levees. A levee is an embankment built to prevent the overflow of a river. The efficiency and equity implications of levees were investigated by […]

E-Growth in Emerging Markets

What is happening in emerging markets? Are there areas where an informed investor can make a profit? What are the pitfalls to avoid? On November 22, 2022, the CFA Society of Toronto hosted a virtual webinar, “Rethinking Emerging Markets: The Case for Growth & How to Capture It.” The speaker was Kevin T. Carter, the founder and Chief Investment Officer of EMQQ Global. Carter began by providing his background. “I pray toward Omaha,” he quipped, because he considers himself an active “value” investor first and foremost, along the lines of “the oracle of Omaha,” Warren Buffett. Carter has collaborated with […]

Towards a Common Standard

Investors around the world are demanding consistent, high-quality reporting of environmental, social, and governance (ESG) data. Is there any global governing body for financial reporting that is up to the task? How can an organization ensure that sustainability reporting is comparable, consistent, and comprehensive? Furthermore, is the input from financial professionals welcomed? The answer, apparently, is “yes” on all three counts. On June 21, 2022, Josina Kamerling, member of the Value Reporting Foundation and the CFA Institute, welcomed an audience of hundreds to a webinar titled “Endgame: Will the ISSB become the comprehensive global baseline for sustainability disclosure?” She introduced the representative […]

The Future of Crypto

What’s been happening in the cryptocurrencies market? Is it all merely speculation or is crypto here to stay? What is the future of broader blockchain technologies? What could regulation mean for the world of decentralized finance (DeFi)? On February 24, 2022, Helen Joyce, Britain editor of the weekly magazine the Economist, posed questions to her colleagues: Alice Fulwood, Wall Street correspondent at the Economist, and Matthieu Favas, finance editor at the Economist, in order to explore the rise of cryptocurrency and its potential consequences. “Blockchain can be thought of as a database distributed across many nodes,” Alice Fulwood said, “one […]

Access to Alternatives

Alternative assets are an important part of modern portfolios—but how can you gain access to them? Do investors and investment advisors know what alternative investment options exist, and what platforms provide them? Do advisors know how to use modern investment platforms to differentiate their offering and provide unique opportunities? How can this type of access on the new platforms enhance the business asset managers? Four panellists convened on October 26, 2021, to discuss these aspects of alternative assets, in a webinar sponsored by the Canadian Association of Alternative Strategies & Assets (CAASA), a trade association representing alternative investment managers, service providers, and investors. The […]

Starting an Alternative Desk

When a finance company is starting up an alternative fund, the managers may have been isolated from the day-to-day tasks such as trading and execution, fund administration, and cyber security. Where does one begin, and how does one prioritize? “Often the IT is overlooked. Some people think they just need a Bloomberg terminal,” said Robert Strawbridge, Vice President, Head of Canada at Options IT, a global leader in fintech managed services, colocation, and cybersecurity. His firm can step in to help. “We manage the cloud services. We do everything but the trading.” Strawbridge was one of four panellists who convened […]

Death of Fundamental Analysis?

Have you been following the market frenzy around stocks for GameStop, AMC and Bed Bath & Beyond? Or the news on Wall Street Bets and Robinhood? How disruptive are these events for traditional valuation methods? What new factors must be considered when investing and allocating capital? Recent shifts in market dynamics have altered the perception of capital markets in meaningful ways. On April 8, 2021, the Corporate Finance Committee of the CFA Society of Toronto convened a panel of experts to discuss the reasons market valuations are so out of synch with fundamental analysis. Moderator Stephen Foerster, Professor of Finance […]

The Achilles Heel of Banking

After last decade’s financial crisis, regulators introduced several new measures to reduce systemic risk in the financial system. How are the new safeguards working? What are the implications for future balance sheet structure? The CFA Society Toronto convened a panel of three experts on November 25, 2020, to discuss the new regulatory capital and liquidity frameworks and how they are reshaping the way Canadian banks approach the market. The webinar, including a Q&A session, was moderated by Nigel D’Souza, Investment Analyst, Veritas Investment Research. “There’s no doubt the financial crisis changed balance sheets,” said Bruce Choy, Managing Director (Former Risk […]

Transforming Healthcare

Great strides have been made in medical treatments, pharmaceuticals and drug therapies, and patient recordkeeping – many of them by for-profit companies. How has the recent advent of Covid-19 shaped these developments? Last week, Pfizer was the first to announce a Covid-19 vaccine candidate. What new financial opportunities await? Three panellists convened on November 17, 2020, to discuss the transformation of healthcare, in a webinar sponsored by the Canadian Association of Alternative Strategies & Assets (CAASA). CAASA is a trade association representing alternative investment managers, service providers, and investors. The panel was moderated by Dr. Ted Witek, Health Care Advisor […]

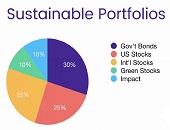

Investing in the greater good

Every day, more investors are converting their portfolios to socially responsible investing (SRI). But does being a socially responsible investor mean you will take a hit on performance? “Over the last five years, responsible investments have done at least as well as the traditional portfolio,” said Tim Nash, a fee-for-service financial planner who spoke at the webinar “Investing in the Greater Good” on August 18, 2020, sponsored by Questrade. Nash is the founder of Good Investing and blogs as The Sustainable Economist. He is also the lead researcher for Ethical Markets Green Transition Scoreboard research report, which details more than […]