Who is taking advantage of the downturn in crude oil prices?

“Most E&P assets are no longer economic to drill at today’s commodity prices,” said Curtis Flood, Vice President at the investment banking firm Evercore. He was the first of two speakers at a webinar “Catch a Falling Knife: Financial Repercussions of Current Crude Oil Prices” sponsored by the Global Association of Risk Professionals on June 7, 2016. (E&P refers to exploration & production, also known as the upstream petroleum industry.)

The downturn in oil & gas prices is “the result of simple economics” caused by the “shale revolution” leading to oversupply: a 53 percent increase in the US between 2009 and 2014. “This outpaced demand by nearly one million barrels a day,” he said.

Flood explained that swing producers, typically Saudi Arabia, decided to let energy markets find their new equilibrium. This led to a dramatic shift in the commodities price environment around June 2014. The price dropped so much that “a lot of companies can’t drill their way to success,” he said, and the asset base is declining.

Flood explained that swing producers, typically Saudi Arabia, decided to let energy markets find their new equilibrium. This led to a dramatic shift in the commodities price environment around June 2014. The price dropped so much that “a lot of companies can’t drill their way to success,” he said, and the asset base is declining.

“E&P operators have four or five big levers to pull,” he said. “Capital expenditures, operating expenses, and SG&A can be cut.” (SG&A is an accounting term for selling, general and administrative expenses.) He cited examples such as cutting year-end bonuses or reducing the corporate head-count. Equity is another lever, with more stock being issued—or the dividend being eliminated. Debt is the fifth lever.

Flood indicated several “solvency red flags” that analysts should look for: accounts payable being delayed; hedges being monetized; delayed SEC filings; reserve based lending occurring; advisors being hired; and bank lines of credit being fully drawn.

From the time of the 2008 financial crisis until 2014, the energy sector chiefly worried about liability management. “The bond market thought there was an attractive yield, but the high yield got overheated,” Flood said. “The sector entered the distressed phase in the summer of 2015” when the price per barrel could not support the high-cost projects.

And now, as we approach the summer of 2016, energy companies “may have locked in cash flow with hedges, but there’s nothing to replace the hedges,” he said. “Hedges [are] starting to roll off over time, and the cash flow is stressed.”

“We’ve started to see some Chapter 11s in the fall of 2015, such as Samson Resources and Magnum Hunter,” which will go through a restructuring or outright liquidation.

Flood said that over $50 billion of Chapter 11 filings have occurred since January 1, 2015, and estimated there may be another $50 billion more.

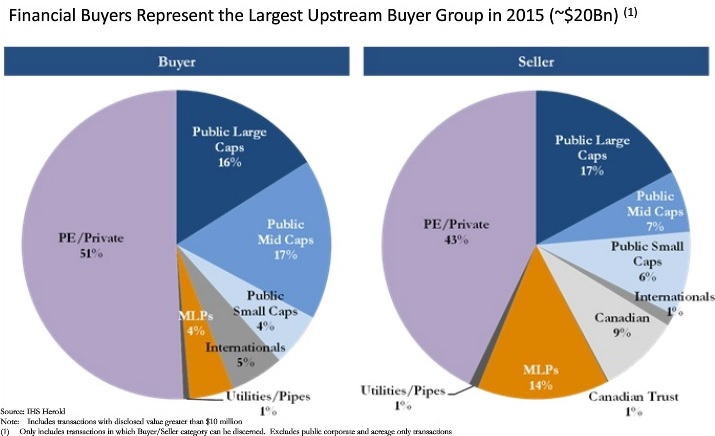

And who is taking advantage of the fire sale prices? “Financial buyers are the largest upstream buyer group. Sometimes private equity is the only bid,” he said, showing two pie-charts, composition of buyers and sellers. The largest fraction of sellers is private equity (43 percent) and the largest fraction of buyers is also private equity (54 percent).

Flood made two conjectures about the future of oil prices. “Iranians have signalled they will grow oil production as much as they can, and the other OPEC nations may or may not slow down,” he said, and went on to outline two possible future scenarios.

In the first scenario, the OPEC nations moderate the growth of the oil supply. There have been some supply disruptions recently. Cancellations of short-term and medium-term projects decrease the supply, leading some experts to speculate there may be a “partial recovery” of oil price, putting it at $60 to $80 per barrel. The global economy would recover.

In the second scenario, OPEC nations turn the oil spigot on full-blast, and the cancellation of marginal projects is not enough to significantly decrease the supply, leading other experts to advise there will be a “new normal” of $50 to $60 per barrel and “muted economic growth.” ª

Click here to read about the second presentation.

Click here to view the webinar presentation. (Available for view until Sept. 6, 2016.)