“There is a surprising under-utilization of common tools,” said David O’Connell, Senior Analyst, Aite Group, a financial services consulting group, during a webinar organized by the Global Association of Risk Professionals on February 20, 2014. He was referring to a survey by Aite Group of about twenty North American commercial loan underwriting professionals (responses as at quarter end Q3 2012).

O’Connell characterized the under-utilization as “surprising” because loan underwriting is such an important part of banking. O’Connell was formerly a loan underwriting and loans officer, and was clearly familiar with the details of commercial lending and its role in “Banking 101.”

Recording all of the underwriting data to satisfy Dodd-Frank requirements—and being able to update and access the data in an organized fashion when an audit occurs—and further, to glean information from the data—can be a real challenge.

Survey Question: Who typically completes the underwriting of commercial loans at your bank? “The deal that exits a signature hierarchy is often much different from what enters,” said O’Connell. A quarter of firms said completion was done by the underwriters. (Underwriters typically provide some counterbalance to loan originators.) Nearly 60 percent said a combination of underwriters and loan officers. A disturbing 16 percent said loan officers or analysts working in the loan origination teams were also responsible for the completion.

Q. What best describes your bank’s investment in the following technologies in support of underwriting processes? “Surprisingly low levels” of automation were used, said O’Connell. At most only 53 percent said they used “tools for automating compliance-related reporting.” Some activities such as submitting borrower documents via web portals were used by less than 20 percent of respondents. O’Connell attributed the low rates of automation to disintermediation.

Of those firms which adopted technologies to support underwriting, two-thirds of respondents said the adoption had resulted in “faster turnaround” and one-quarter said “higher win rate.”

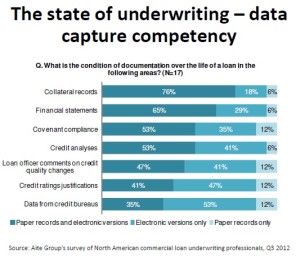

Q. What type of documentation (electronic, paper) is collected over the life of a loan in the following areas? Most respondents said their banks used mixed paper/electronic records. The percentage use of electronic, paper, and mixed varied according to type of documentation. The above chart shows the breakdown for different types of documentation (collateral records, financial statements, covenant compliance, credit analyses, loan officer comments on credit quality changes, credit ratings justifications, and data from credit bureaus). ª

Click here to go to Part 2, Missed Opportunities in Commercial Credit Analytics. ª

Click here to go to webinar presentation slides on Commercial Credit Analytics.

The Twitter feed for David O’Connell is at: https://twitter.com/davidpoconnell