“How can an institution practically approach credit workflow when it might not be streamlined? How can we optimize existing processes?” These questions were posed by Justin Huhn, Credit Assessment & Origination Practice Leader at Moody’s Analytics Enterprise during a webinar arranged by the Global Association of Risk Professionals on September 24, 2013.

Huhn noted that, as of Q1 2013, there were over seven thousand insured commercial banks and savings institutions in the US excluding foreign branches. These financial institutions tend to develop silos of expertise. Workflow optimization is of pressing concern to many.

In 2008 the American Bankers Association estimated that 65 percent of financial institutions need an automated workflow process to be developed or markedly improved. During his talk, Huhn fleshed this out with a description of value generation and sources of errors for typical banks. He discussed the need for standardization, the prelude to automation, followed by the practicalities of optimization.

To develop a workflow model, there are three phases: assessment (which typically takes 8-10 weeks); enhancement (12 weeks); and technical deployment (time frame depending on what is uncovered in the first two stages).

Huhn sees three sources of value generation at banks: release of reserves or provisioning; reduction in the retail footprint as banks moved from bricks-and-mortar to a greater on-line presence; and optimization of workflow. The third is of foremost interest to his group at Moody’s Analytics. “You can increase efficiency by reducing operational redundancies,” he said, and this will translate to lowered personnel expenses.

Ideally, increased efficiency does not mean increased error. Huhn divided the types of error occurring during credit approval into two types: substantive, which involves choice of appropriate model, good segmentation, etc.; and procedural, when something about the assessment process is incorrect.

There could be inconsistent segmentation across sales and risk analysis. There could be conflict between short-term gains and long-term objectives. “For example, the sales force may be incentivized for closing the deal, not for ensuring that it’s a solid deal,” Huhn said. Another error could involve hierarchical layers in the institution, none of which takes responsibility for ensuring a healthy credit process.

Huhn said the maturity level of workflow process efficiency varies greatly from bank to bank. In the early stages of developing its workflow, a bank may be “procedurally unsound,” and over time it might progress to “operationally sustainable,” and eventually to “operationally optimized.”

“The more we can standardize, the more we can hand over to IT to automate,” said Huhn. Two such candidates for standardization are documentation and review processes. If properly harnessed, automation will reduce procedural errors. “We will have more prudent risk management,” said Huhn, because automation will ensure that appropriate internal controls will be in place. For example, good software design will ensure the bank is applying anti-money-laundering rules every time a sale is made.

“The aim is to get a scalable model,” said Huhn. “The benefit is that this will enable risk-based or relationship-based pricing.”

Huhn suggested that each bank should consider its Target State Workflow Operating Model (TSWOM), or “reference model,” across the organization, and identify the areas of leading and lagging practices. Then, it become a matter of how to close the gap for practices that lag “best practice.”

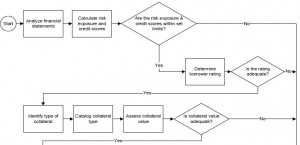

Irrespective of the type of credit, some processes are the same throughout. For example, in prospecting and sales, the bank needs a preliminary understanding of client exposure, and this entails generic activities such as “conduct background check” and “monitor follow-ups.”

The “biggest bang” for the automation buck, according to Huhn, lies in reviewing the loan completeness and plausibility. “A good screening process will save a lot of time and money.”

Huhn noted there is a range of sophistication for credit analysis and risk models. The borrower probability of default determination was largely quantitative but may have some qualitative component such as rating the “quality of management.”

Assessing the collateral value (calculation of loss given default and exposure at default) could involve some extra knowledge. For example, an aircraft posted as collateral will quickly lose its value if it is not constantly maintained.

Huhn laid out the guidelines and framework for the overall approach. He encouraged the audience to begin the work—or press onward, as the case may be—with workflow optimization. The benefits are significant, both for error reduction and value generation. ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=678040&s=1&k=54841264D01A01E1888DDAA737060AC8>