“Turn the pain of compliance into the benefit of strategy,” said Thomas Caragher, Senior Product Manager of Financial & Risk Management Solutions at Fiserv, a US provider of financial services technology. He was speaking about the approaching deadline to implement new guidelines for current expected credit losses (CECL) at a webinar sponsored by the Global Association of Risk Professionals on April 11, 2018.

CECL is the new impairment standard for credit impairment under the Financial Accounting Standards Board (FASB). Since it affects accounting, the effect of CECL will be felt “in department stores, cell phone companies, municipalities”—throughout the U.S.

The purpose of business intelligence is to identify new opportunities and implement an effective strategy to gain competitive market advantage, so the changes to CECL should be viewed as a good challenge, he suggested.

He urged the audience to bear the CECL timeline (2020 – 2021) in mind. “For most of us, the timeline is compressed,” he said. “When questions start coming from auditors and regulators, you’d better be able to answer them.” In many companies, the CECL team is concerned about how aware the C-suite is about the magnitude of the change, even at this late stage.

“You need a lot of data,” Caragher said. If your company makes 5-year loans, you will need at least 5 years of data. “The auditor will ask if you have longer-lived assets” and many companies do. He suggested 7 to 10 years is a good data benchmark.

“Most institutions have nowhere near that” so the next question is how to backfill. If you don’t have enough years of data, he urged CECL teams to “ask the auditor whether four years is enough, if [they are] making a good faith effort.”

When it comes to data, “more is better.” A company can optimize data and results, moving from being reactive to proactive—to actually optimizing its business. He empathized with employees who have to do yet another job with limited resources, but he encouraged them to stretch to meet the goal.

He showed how to drill down with analytics by considering 4 levels of analysis.

- What happened? “Descriptive analytics is the bare minimum,” he said.

- When did it happen? “Now you can correlate it to things such as economic states, or changes in the customer base.”

- What will happen? “This gets into predictive analysis.”

- How can we make it happen? This is the ultimate reward. “Prescriptive analysis” will show where insights gained can be used drive more business.

The company must understand risk is integrated and interconnected. Accounting, treasury, budget and planning, marketing, as well as asset-liability management departments are stakeholders “who must come to the table.” The data system should be set up so that additional data the stakeholders need can be captured, too.

Next, “the team will want to know how risks correlate.” For example, interest rate risk will have an effect on concentration risk and all material risks will affect liquidity.

Caragher thought the hardest people to bring into the room would be credit risk. “Does interest rate risk cause more credit defaults? Looking at silos won’t give the answer.”

“We need historical data to support assumptions,” he said. On his slide he listed many data variables, such as original loan-to-value (LTV) ratio, current LTV ratio, charge-off amounts. Plus, geographic information should be gathered.

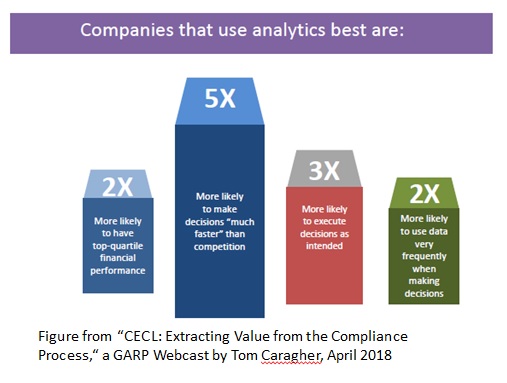

Companies that use analytics best “are five times faster at responding to changes in the marketplace environment”—and are twice as likely to have top-quartile financial performance. ª

Click here to read about Part 2 of the presentation.

Pliers picture is from http://blog.keboola.com/

Click here to view the GARP Webcast- CECL: Extracting Value From the Compliance Process