“The central bank stimulus has been significant—what will happen as it’s withdrawn?” asked Seth Rooder, Global Credit Derivatives Product Manager at Bloomberg. He was the second of two speakers to consider the effects of tapering in a GARP webinar presentation on November 21, 2013.

A key question is: “when will the Fed taper?” Rooder said not soon, because with unemployment still above 6.5 percent, Vice-Chair of the Fed Janet Yellen will have unwillingness to taper. Currently, the Fed is pumping money into the system by buying $40 billion in mortgage-backed securities and $45 billion in Treasury bills per month. He pointed to a recent large move in 10-year Treasuries (1.6 percent in May jumping to 3.0 percent in September) simply on the rumour that tapering was about to occur.

The US government shut-down in 2013 has only “been kicked down the road” and will recur soon. “Even a technical default can damage financial markets,” Rooder said. “The situation was benign but it’s still a tail risk.”

“Earnings have been surprising—to the upside,” Rooder said, noting growth of 4.4 percent. Could the positive earnings outweigh the fears of tapering? Economic growth does not seem that strong; it could be that equity markets are expecting a mass re-leveraging.

“Credit has performed well, but spreads have hit a floor,” according to Rooder. Cash behaviour is usually similar to credit derivatives behaviour. Leveraged loans have rallied to the point they are almost on par in 2013. Bond issuances are occurring at a rapid rate, and leveraged loan issuance has “exploded,” he said. Issuance is “handily outpacing” maturities redemption as corporations refinance earlier to take advantage of good rates.

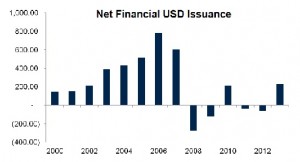

Bank net issuance of corporate bonds peaked in 2006 and has swung between positive and negative since then. The financial sector has been converging to the non-financial sector yields, and now banks are seen as just as risky as other sectors. Materials and consumer staples have been underperformers.

The year 2013 has been a “big year” for Dodd-Frank implementation, Rooder said. He covered the roll-out timetable for Dodd-Frank in detail. [Ed. Note: see slide 44 of the November 21 presentation, viewable at GARP website link given below.]

“A revolutionary moment in derivative reporting” was the January 2013 display of the first ever “tape” for credit derivatives. As per regulatory mandate, Bloomberg is capturing data on credit, interest and exchange rates, commodities, and equity derivatives and displaying it via the SDR command.

“We can now analyze volumes and trends in derivatives markets,” said Rooder. The software will highlight abnormally high or low intraday volumes and help analysts spot unusual activity.

During the Q-and-A session afterward, Rooder said he thought the exchange rates of the USD and euro should be increasing, although right now they are “moving into negative territory.” His market expectations for 2014 are slow growth in Q1 and Q2, speeding up in Q3 and Q4, although “it will not be moving to potential any time soon.”

The webinar concluded with the moderator, Eric Cavanagh, emphasizing the “treasure trove” of information for building financial models that will now become available with the new “tape” for the derivatives market. ª

Link to view the webcast “Eye on the Credit Markets- Regulation and Tapering”: http://event.on24.com/r.htm?e=707665&s=1&k=12F1D2BCB57C7303861F106E8169E09F>