“How will the credit markets perform if the Federal Reserve Board chooses to taper over the next year or so?” asked Sivan Mahadevan, Head of U.S. Credit Strategy and Global Credit Derivatives Strategy at Morgan Stanley. He posed this question to members of the Global Association of Risk Professionals on November 21, 2013. Here, “tapering” refers to a gradual lessening of asset purchases.

As the first of two speakers in a webinar presentation, Mahadevan summarized the credit markets to date: “little beta, lots of alpha.” Investment grade assets have had a good rally this year. “The higher yields go, the better we feel,” he said. As for models, the one-zone gross domestic product (GDP) forecast shows slightly tighter spreads year-over-year. The 30-year yield is at its highest in the past two years. Overall, Mahadevan predicted outperformance of credit markets in the 3 to 7-year part of the curve.

Things look better for pension funds and insurance companies. The top 100 companies with defined benefit pension plans are now about 90 percent funded. A drop in Treasury yields, combined with an equities sell-off, brought them more to the 70 percent level, however. Companies far and wide are trying to defuse the pension liability, he noted.

There are significant discount opportunities in investment-grade credit. Thirty percent trades below par, Mahadevan said, purely because of rates, creating an “interesting convexity opportunity.” As well, the mergers and acquisitions environment is heating up. High yield and municipal bonds should be viewed cautiously; for these, the market appeared “overly sanguine.”

Mahadevan discussed approaches to valuing bank structures. The eight to ten largest banks in the US have seen their balance sheets change materially. “History is not much of a guide because so much has changed,” he said, pointing to the different regulatory framework banks are in now. Instead, “the market is looking for frameworks” to value banks.

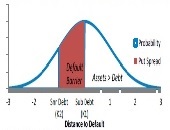

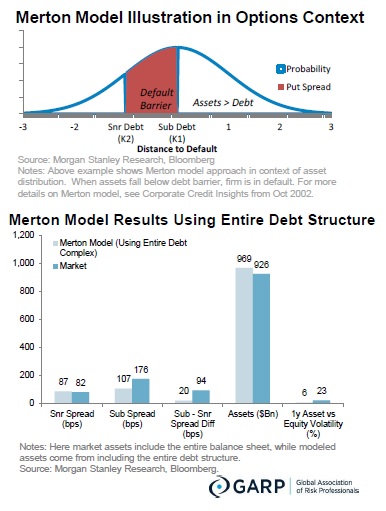

His group at Morgan Stanley has two useful approaches: the Merton model, which uses equities model information valuing senior debt and subordinate debt; and a risk-neutral type of approach that has a securitization-type model to determine the expected losses of a bank’s asset portfolio to help price the debt capital structure.

Application of the two techniques to today’s markets shows senior spreads for banks seem appropriate, Mahadevan said, but the subordinate debt spreads are projected to be a little tighter 3 months down the road.

T he Merton model is accessed through the Bloomberg DRISK module. The model can use equity and volatility information, but the drawback is that it can’t deal with the portfolio in a very granular fashion.

he Merton model is accessed through the Bloomberg DRISK module. The model can use equity and volatility information, but the drawback is that it can’t deal with the portfolio in a very granular fashion.

The securitization or risk-neutral framework is accessed through the CDST module in Bloomberg. This permits the user to deduce the fair market spread for valuation but the drawback is that the model can’t use some equity market information out there.

And there’s a bonus to setting up such models. Mahadevan said the two models not only give a good idea of the spread for senior and subordinate debt, they are also good tools for scenario testing. ª

Link to view the webcast “Eye on the Credit Markets- Regulation and Tapering”: http://event.on24.com/r.htm?e=707665&s=1&k=12F1D2BCB57C7303861F106E8169E09F>