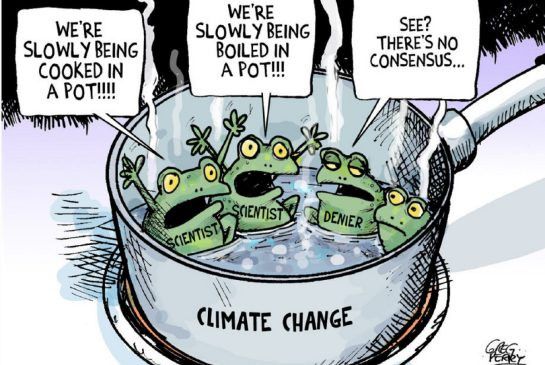

Climate change will reshape how financial organizations and investors think about climate-related events. But how will we deal with climate change risk? How will financial organizations respond to increasing demands for transparency, measurement, and action?

On February 2, 2021, the Institutional Asset Management Committee of the CFA Society of Toronto convened a webinar with three seasoned experts who discussed how best to move into a world of green initiatives. The session was opened by Brandon Gill, Senior Portfolio Manager, Capital Markets Group, External Public Investments and Credit at OPTrust, the pension trust fund of the Ontario Public Service Employees Union.

Helping clients cope with climate risk cannot be done in a one-size-fits-all manner, said Meredith Jones in her opening statement. “One person says ‘sustainability’ and the other hears ‘divestment’.” Jones is an environmental and social corporate consultant at the global professional services firm Aon and author of Women of The Street: Why Female Money Managers Generate Higher Returns.

“We do not follow [environmental] indices—we do detailed due diligence,” said Bertrand Millot, VP Risk Management, Fixed Income and Head of Climate Risk and Issues at Caisse de dépôt et placement du Québec (CDPQ). The CDPQ climate-change journey began in 2016, when an analysis showed about 80 percent of the environmental issues were due to 20 percent of the assets.

“We had to set targets because finance works well, given targets,” Millot said. “We came up with targets in line with countries, not science.” Further, the CDPQ split the targets among asset classes. “We tied remuneration to targets. This really gets people’s attention” and the targets are now often exceeded. The CDPQ is one of the founders of the movement to reach net zero by 2050.

“We engage with groups like Climate Action 100,” said Daren Smith, President & CIO at University of Toronto Asset Management (UTAM). “We do advocacy work and we talk to rule-setters.” They have publicly endorsed the Task Force on Climate-Related Financial Disclosures (TCFD) and they also have leadership positions on the Canadian Council for Good Governance (CCGG).

Moderator Alison Loat asked questions relating to three pillars of sustainability: governance, strategy, and metrics. She is Managing Director, Sustainable Investing and Innovation at OPTrust.

“We are not tree-huggers,” said Millot, “we are doing this to mitigate risk.” Internally, his group does a lot of education of senior management and the whole organization, “including IT, who make the data available” for carrying out metrics.

Caring about sustainability “is just being a good investor,” agreed Smith. “We link compensation to ESG indicators.” ESG is the umbrella term for environmental, social, and corporate governance.

Jones said she has an “expectation of a robust governance structure” at good companies. Clear delineation of performance measures is important. Aon ESG consultants ask, “are people compensated on the basis of ESG?” Some firms only have one person whose performance review depends on hitting ESG targets, and that signals the company is not serious about addressing climate risk.

Strategy

There is more than one strategy for achieving ESG goals. “Think about what levers you can apply for ESG,” Jones urged. “Divestment is only one lever. For example, a firm can “switch from passive beta to ESG beta.”

Millot said that strategy is complex. “Measuring the carbon footprint is crude but effective.” He suggested looking at the whole business risk. “For example, the main source of income for wind turbines is the weather, which will change as the climate changes. Or a hydroelectric dam—ask if rainfall will continue to the same extent when the climate changes,” he suggested. “Look at a very long term horizon.”

For strategy, Smith prefers a manager-to-manager approach. UTAM looks for the best-in-class managers and gets them to manage their assets. “So, we must evaluate the asset managers. We ask for all of their returns each month.”

Loat asked panellists to describe the key points of resistance when trying to implement climate-change policies.

Millot contrasted the younger members of the investment team, who say “yes, this is great!” to the older members, who feel climate-change goals will mean greater interference with their work. “So we give them a carbon budget and let them work it out.”

“I don’t break it into generations,” Jones said, “but rather, those with legal or compliance background. Fiduciary duty makes them resistant.” Climate change requires a forward-looking mindset.

If Millot is facing resistance, he tells them: “Just read the newspaper! By 2022, there will be a 30 billion euro fine in Europe – that is a risk.”

To counteract resistance, Smith has one-to-one dialog with key stakeholders. He shows them the possible scenarios and asks, “why wouldn’t you want to guard against this?”

Metrics

Smith noted that carbon intensity is the most common metric. Fund managers should aim for a 40 percent reduction. “That’s ambitious, but not so aggressive it would have a negative effect on the portfolio.”

Millot emphasized the importance of sticking with one data provider, rather than “data shopping” to get the most favourable numbers. The next frontier at CDPQ is to measure net zero. “That’s extremely complex, and is prone to greenwashing.”

To make the key indicators stick, “you must do the legwork and have good buy-in,” said Jones. “It will take more than three months to implement.”

“Of all the indicators,” Smith said, “you have to figure out what’s most important to the client, and then incentivize.”

One Lesson Learned

To wrap up the session, Loat asked each participant to summarize their most important learning to date.

Millot: “Don’t underestimate the amount of education that needs to be done. Make sure that knowledge is well sprinkled throughout the organization.”

Smith: “You have to start somewhere. Get some help from consultants or groups that are working on climate change.”

Jones: “You need to figure out what are the pockets of resistance in your organization and address them—without making people feel threatened. They might say, ‘I don’t care about the whales.’ Fine, then I will find a climate issue they do care about.”♠️

The Oliver Wyman report Bernard Millot referred to can be found at: https://www.oliverwyman.com/our-expertise/insights/2020/jul/european-banking-sector-outlook-2020.html