On August 16, 2012, three panellists gave a perspective on the changes Basel III would wreak on capital instruments. It was a highly detailed talk, delivered at high speed, with many qualifications made to the main points, but the sponsoring organization GARP has done a tremendous service to its membership by gathering together these experts. There are some excellent summary slides (link below). This two-part posting showcases the top messages from the three experts, Dwight Smith, April Frazer, and Steve Sahara. In June 2012, three US regulatory bodies (the OCC, the Federal Reserve Board, and the FDIC) proposed three sets of significant changes to financial regulation: Basel III, the Advanced Approach, and the Standardized Approach.

Dwight Smith, Partner, Morrison Foerster, laid the legal groundwork for how Basel III affects capital components. In essence, he noted, the old-regime Tier 1 capital is broken in two, Common Equity Tier 1 (CE Tier 1), and Additional Tier 1. The US agencies believe most instruments will not experience a “dramatic shift” in the reclassification, Smith said. For each of the three types of capital (CE Tier 1, Additional Tier 1 and Tier 2), Smith described three things: the elements of its categorization, the criteria, and the treatment of minority interests. For CE Tier 1, he also sketched out the adjustments and the transition deductions. Additional Tier 1 was rather a “catch-all” category for nearly all instruments in Tier 1 under the current rules that do not qualify as CE Tier 1. There will be two exclusions from Tier 1 capital: cumulative preferred stock, and trust preferred securities, which will now be categorized as Tier 2.

For each of the three types of capital (CE Tier 1, Additional Tier 1 and Tier 2), Smith described three things: the elements of its categorization, the criteria, and the treatment of minority interests. For CE Tier 1, he also sketched out the adjustments and the transition deductions. Additional Tier 1 was rather a “catch-all” category for nearly all instruments in Tier 1 under the current rules that do not qualify as CE Tier 1. There will be two exclusions from Tier 1 capital: cumulative preferred stock, and trust preferred securities, which will now be categorized as Tier 2.

For each of the three types of capital (CE Tier 1, Additional Tier 1 and Tier 2), Smith described three things: the elements of its categorization, the criteria, and the treatment of minority interests. For CE Tier 1, he also sketched out the adjustments and the transition deductions. Additional Tier 1 was rather a “catch-all” category for nearly all instruments in Tier 1 under the current rules that do not qualify as CE Tier 1. There will be two exclusions from Tier 1 capital: cumulative preferred stock, and trust preferred securities, which will now be categorized as Tier 2.

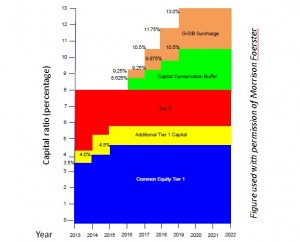

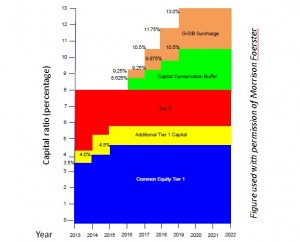

For each of the three types of capital (CE Tier 1, Additional Tier 1 and Tier 2), Smith described three things: the elements of its categorization, the criteria, and the treatment of minority interests. For CE Tier 1, he also sketched out the adjustments and the transition deductions. Additional Tier 1 was rather a “catch-all” category for nearly all instruments in Tier 1 under the current rules that do not qualify as CE Tier 1. There will be two exclusions from Tier 1 capital: cumulative preferred stock, and trust preferred securities, which will now be categorized as Tier 2.Near the end of his presentation, Smith provided a very succinct image of changes in capital ratios for the different types of capital. (Reprinted here with permission of Morrison Foerster.) It deftly captures the ramping-up planned for capital, with the various types of capital ratio as a function of calendar year. The viewer will see that the capital ratios of CE Tier 1 / Additional Tier 1 / Tier 2 / Countercyclical buffer / G-SIB Surcharge will be 3.5 / 1 / 3.5 / 0 / 0 in 2013 moving to 4.5 / 1 / 2.5 / 2.5 / 2.5 in 2019. [Ed. Note: G-SIB stands for “global systemically important bank.”]

Click here to go to Part 2 of the posting. ª

The webinar presentation slides can be found at: http://event.on24.com/view/presentation/flash/EventConsoleNG.html?uimode=nextgeneration&eventid=501727&sessionid=1&username=&partnerref=&format=fhaudio&mobile=false&flashsupportedmobiledevice=false&helpcenter=false&key=BB2BCDA3C03C38EFC8833D06AC6AAA3E&text_language_id=en&playerwidth=1000&playerheight=650&overwritelobby=y&eventuserid=67720035&contenttype=A&mediametricsessionid=54710146&mediametricid=929886&usercd=67720035&mode=launch#