On December 20, 2012, the second presenter at the GARP webinar on the LIBOR scandal was Cliff Rossi, Executive-in-Residence, Center for Financial Policy, University of Maryland. He described the risk implications arising from the Wheatley Review of LIBOR.

Rossi noted that some market participants were “still feeling PTSD from the financial crisis of 2008”—and then they got hit with the LIBOR scandal. Rossi succinctly described what went wrong: Low volume in interbank lending in unsecured transactions created an over-reliance on “expert judgement” hence the rate was subject to manipulation.

Part of the problem, Rossi said, is that LIBOR reporting was not done on an anonymous basis. In times of crisis, banks were submitting lower lending rates than what they actually used so they would look good. There were two sources of a conflict of interest, Rossi noted: credit signalling, and the real economic incentive to support each bank’s trading position.

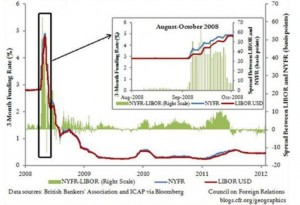

At the time of the financial crisis, there was significant disparity between the New York Federal Reserve NYFR) rate and LIBOR [see accompanying graph] but apparently there was not a lot of discussion about the disparity. Even now, with empirical research seeking to prove the existence ofmanipulation, statistical analysis “stands on both sides,” said Rossi. It was simply unclear.

The rigged LIBOR rates may have understated the magnitude of the financial crisis. “Fannie Mae and Freddie Mac are still experiencing LIBOR issues on the order of $1 billion. … We may have whistled past the graveyard,” said Rossi, but the extent of the impact may be bigger than first estimate. It clearly requires further investigation.

There are both realized and potential risks connected with the LIBOR scandal, Rossi pointed out to the audience of risk professionals. It exemplifies regulatory, reputational, and legal risk. Class action lawsuits continue to be announced. The market risk component is largely transactional and systemic risk.

Rossi expressed reservations about the Wheatley Review. Similar to the first presenter (Amy Poster), he urged regulators to reform, not replace, LIBOR. “The proposed replacements are not ready for prime time,” he said. Whether looking to reform or replace, Rossi urged that (a) actual transaction data should be used and (b) it should involve market participants, not authorities.

Reforms are underway but to Rossi’s mind, “they didn’t go far enough.” What would Rossi change, if he could? There should be anonymous submission, the loans should be of shorter tenor, and he would broaden the base of contributing banks. He recommended migrating to alternative benchmarks such as the Overnight Index Swap.

“Meaningful reform is necessary for maintaining credibility,” Rossi emphasized. ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=547384&s=1&k=36B76CF8E61746B331EA26D40448235C