Have you noticed that financial risk managers talk and think differently about liquidity risk, compared to pre-crisis days? The 2007-08 financial crisis was a watershed in the evolution of liquidity management, according to Nicolas Kunghehian, Director Solutions Specialist at Moody’s Analytics. He was the second of three presenters on liquidity risk compliance at a webinar on June 25, 2015, sponsored by the Global Association of Risk Professionals.

“Before the crisis, there was only one team dedicated to monitoring and managing liquidity,” Kunghehian said. Liquidity risk was assumed to be small, and the Treasury department was chiefly fine-tuning the profit and loss (P&L) reporting. “It was easy to find liquidity on the market.”

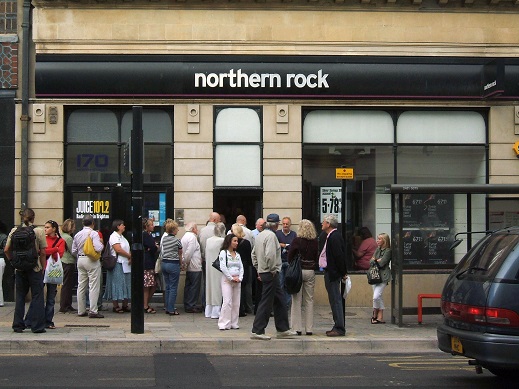

“After Northern Rock, we knew it was possible to go bankrupt in a very short time,” he said. The change in mindset led to greater regulatory pressure, and different reporting metrics than previously.

“Top management has decided to change data governance.” The tools, software, and internal organization all had to be changed in order to be able to run stress testing within a short period of time, and consolidate reports for the whole enterprise, no matter how many jurisdictions.

Top level executives wanted to be aware, because they would be first affected, and the first called upon to answer to external reports.

In the new regime, there are “new missions,” he noted, and these involve top management. “Customers must decide whether they go for strategy or tactics.”

Kunghehian identified three new trends: integration under the enterprise; a large regulator impact; and greater performance monitoring.

All risks are integrated under a single framework, that of enterprise risk management, which is governed by the Basel guideline BCBS 239. Funds transfer pricing (FTP) is used to combine and compare all costs that are monitored.

Referring to the liquidity compliance ratio (LCR), he said the calculations can no longer be simply handled with Excel tools. There is a need for industrialization. ª

Click here to read about the first presentation.

Click here to read about the third presentation.

Photo by Dominic Alves from Brighton, England – Northern Rock Queue

Note: at the time of posting, bank queues were appearing all over Greece. This photo accompanies an article at The Blaze.com.