On July 17, 2012 Peter Went, VP Banking Risk Management Program at the Global Association of Risk Professionals (GARP), addressed a webinar audience on the significant changes to capital requirements under the new Basel III rules, as was reported in the Part 1 posting.

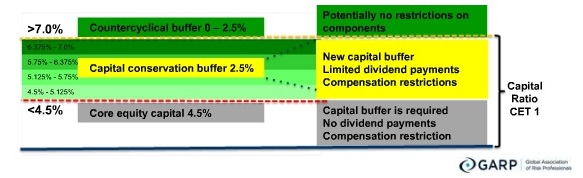

According to the survey of the Basel Committee Basel III Monitoring Exercise, many banks have embarked on aggressive campaigns to raise capital. In addition to increasing existing capital requirements, Basel III proposes two new charges: the capital conservation buffer, which may require banks to maintain an additional 2.5 percent, and the countercyclical buffer (shown in the accompanying figure).

A bank’s national regulator can trigger a requirement for the countercyclical buffer during periods of excessive growth, thereby requiring banks to hold as much as an additional 2.5 percent of capital reserves, said Went. How this will work in practice is still uncertain. For example, an internationally active bank may be operating in several jurisdictions, where the host country regulator might have triggered the capital buffer. Given the one year for banks to raise this capital , there may be some implementation lag. Furthermore, once the trigger is released and the capital is no longer needed, how will the capital in the countercyclical buffer be appropriately dissolved?

Furthermore, Basel III implementation will change the risk-weighted assets (RWA). In many cases, the risk weights increase substantially, reflecting the experience regulators have gained during the crisis. Went also gave an overview of the Basel III capital instruments’ eligibility criteria. Global systemically important banks (G-SIBs) must have greater loss absorbency capacity, and this means even more high-quality core Tier 1 capital.

While there have been substantive implementation attempts globally, in June 2012 the US federal banking regulators released their comprehensive proposal to implement parts of Basel III. The OCC, FRB, and FDIC made three separate proposals that extend parts of Basel to most US financial institutions. Once these rules are implemented, they will cover all financial institutions with more than $500 million in assets. Given the approximately 7,400 institutions in the US, approximately 1,500 institutions will become Basel III compliant. A smaller subset of largely internationally active financial institutions will be subjected to a more complex regulatory structure.

Overall, the Basel III proposals are changing capital needs and capital requirements. Both regulators and the financial industry have presented several research reports assessing the ultimate impact of these rules on bank capital levels, profitability, economic growth, and financial stability. Most of these studies agree, as emphasized by a recent OECD study, that higher capital requirements will have adverse effects. The differences between studies is due to various assumptions that drive the results. Ultimately, the industry agrees that the long-term impact, although difficult to quantify, can be mitigated by a low interest rate policy, Went said.

The Macroeconomic Assessment Group (comprised of FSB and BCBS representatives) issued an interim report in August 2010. Went has collected a listing of eleven major consultative proposals that pertain. (These are part of the slide show whose URL is given below.)

During the question period, Went stated that if banks may not fulfill the regulatory capital requirements, they can be shut down by regulators. Although the global economy may be poor, governments are unlikely to backtrack on Basel III, he opined.

If some national regulators are lax in implementation, for whatever reason, capital arbitrage will occur. Capital arbitrage is embedded in the strategy of large institutions. “The more capital the banks have,” said Went, “the more stable the system will be.”

Given the long implementation time-frame, there are some national priorities. Went argued that there are fast responses on some items such as banks’ living wills. On the whole, he said, it is important to take a long-term view of the regulatory framework, weighing the costs and the disadvantages against the long term benefits and stability.

. ª

The webinar presentation slides can be found at: