What is shadow banking, and are the associated risks being properly mitigated? A summary of issues can be found in the webinar “Shadow Banking: Standing at the Precipice?” sponsored by the Global Association of Risk Professionals (GARP) on August 6, 2019.

Fabio Natalucci, Deputy Director, Monetary and Capital Markets Department of the International Monetary Fund (IMF), was the first of two speakers at the one-hour webinar. He began by explaining that the shadow banking system prefers to be thought of in “less sinister” terms as “non-bank financial intermediaries” that provide services similar to, but outside of, the regular banking system.

He described five economic functions fulfilled by shadow banking.

- They are collective investment vehicles with features that make them susceptible to runs – this is by far the largest economic function of shadow banks, estimated by the IMF in 2017 to account for 70 percent of the economic activity by shadow banks.

- They provide lending dependent on short-term funding

- They provide market intermediation dependent on short-term funding

- They facilitate credit intermediation – this accounts for less than 1 percent

- Lastly, they provide securitization-based credit intermediation –this is only about 10 percent of the economic activity in 2017.

Of the five functions, the two fastest growing are collective investment and securitization. “The amount of assets in non-bank intermediaries is increasing year over year,” Natalucci said, “with different trends over time, and over different jurisdictions,” as measured by the share of total national financial assets. He contrasted the extreme case of Cayman Islands (increased shadow banking) with other regions such as the U.K. (slowly decreasing).

Natalucci quantified the growth of “narrow measure” assets (those with greatest liquidity) by economic function from 2003 until 2018. “Vulnerabilities are rising, and vary by region,” he noted.

Looking at economics as a whole, he broke down the vulnerabilities of six sectors: sovereigns, nonfinancial firms, households, banks, insurers and “other financials” (the latter being the shadow banks). “Vulnerability is like an amplifier” to any financial stress in a sector.

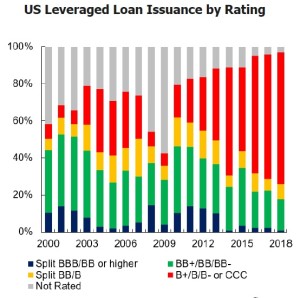

The corporate credit cycle is maturing in the U.S., so non-bank lenders are starting to play a greater role. “Non-bank lenders now account for the majority of lending in the States,” he said. As well, the U.S. leveraged loan market has grown in both size and complexity. “There’s been a consistent weakening of credit quality over time.”

As well, the non-bank investor base has expanded, and this, along with other indicators, led Natalucci to pose the question: “Are these signs of late-cycle dynamics?”

He moved on to discuss the web of linkages in China’s financial system. He estimated the size of “other financial institutions” (i.e. the shadow banking system) to be around a staggering RMB 24 trillion or $3 trillion USD.

Although regulatory tightening has slowed credit risk erosion, risks remain elevated in investment vehicles. He compared wealth management products (WMP) to corporate bond yields; the WMP typically have better yields.

He noted there are risks to financial stability from trading activity. A question was posed in the Q & A section of the webinar regarding the influence of the recent China – U.S. trade war. “There would be direct impact from tariffs,” he said, and it also “affects confidence” and the “appetite to invest.”

“There are regulatory tools to curb the risk,” he said, noting that the chief risks on the balance sheet to be mitigated are: leverage, liquidity, maturity, and FX mismatch. However, in countries with elevated vulnerabilities, “we don’t know exactly what regulatory tools are available.” ♠️

Click here to view the one-hour webinar presentation.

The research paper by Fabio Natalucci that it’s based on can be found on the GARP website at: https://www.garp.org/#!/risk-intelligence/all/all/a1Z1W0000054xEzUAI

The first graphic is from his webinar presentation; the second is from the BBC website: https://www.bbc.com/news/business-45556345

Click here to read about the presentation by the second panellist, Cindy Li.