Transition & Stability

The increasing frequency of extreme weather events in Canada has caused the annual payouts for catastrophic insurance claims to skyrocket, according to a recent Statistics Canada report. This is but one small piece of a global picture emerging, where extreme weather events are causing homeowner insurance to increase at a rate higher than inflation. In the worst case, climate change will cause insurance companies to go bankrupt and homeowners will have nowhere to turn. “Transitions happen shock-wise and are systemic,” said Dirk Schoenmaker, Professor at the Rotterdam School of Management. “What can we do to reduce transition risk?” He was speaking at a webinar […]

The Achilles Heel of Banking

After last decade’s financial crisis, regulators introduced several new measures to reduce systemic risk in the financial system. How are the new safeguards working? What are the implications for future balance sheet structure? The CFA Society Toronto convened a panel of three experts on November 25, 2020, to discuss the new regulatory capital and liquidity frameworks and how they are reshaping the way Canadian banks approach the market. The webinar, including a Q&A session, was moderated by Nigel D’Souza, Investment Analyst, Veritas Investment Research. “There’s no doubt the financial crisis changed balance sheets,” said Bruce Choy, Managing Director (Former Risk […]

Platform of the Future

What will be the ideal modelling platform of future bankers? It will need to contain key functionalities in model execution, scenario management, and a “risk engine” that will deliver answers for multiple horizons at the loan level. Furthermore, it should implement the most advanced modelling suites, reduce the quants’ time to develop models, and contain simulation capabilities for stress testing and beyond. This bold vision of the future was presented by Martim Rocha, Advisory Business Solution Manager at SAS. He was the second of two presenters at the February 25, 2016, webinar offered by the Global Association of Risk Professionals […]

3 Steps to Liquidity Compliance

Are you scrambling to adjust to new reporting expectations for liquidity risk? Getting good data is key, but “you have to get it right and on time,” said Pierre Mesnard, Director Solutions Specialist at Moody’s Analytics. He was the third of three presenters on liquidity risk compliance at a webinar on June 25, 2015, sponsored by the Global Association of Risk Professionals. Once you have the data, there are three steps to delivering integrated liquidity compliance and business management, said Mesnard. First, you must ensure all financial instruments at your bank can be adequately modelled in order to generate realistic […]

Liquidity: A Change in Governance

Have you noticed that financial risk managers talk and think differently about liquidity risk, compared to pre-crisis days? The 2007-08 financial crisis was a watershed in the evolution of liquidity management, according to Nicolas Kunghehian, Director Solutions Specialist at Moody’s Analytics. He was the second of three presenters on liquidity risk compliance at a webinar on June 25, 2015, sponsored by the Global Association of Risk Professionals. “Before the crisis, there was only one team dedicated to monitoring and managing liquidity,” Kunghehian said. Liquidity risk was assumed to be small, and the Treasury department was chiefly fine-tuning the profit and […]

An Opportunity To Get Things Right

When it comes to forecasting liquidity risk, does your bank follow best practices? It might be tough to do so, because of a “data conundrum,” said Gudni Adalsteinsson, author of The Liquidity Risk Management Guide – from Policy to Pitfalls. Banks carry out a “retrospective analysis” on data that is “not forward looking.” Adalsteinsson, Head of Global Liquidity, Group Treasury at Legal & General Group Plc, was the first of three presenters on liquidity risk compliance, at a webinar on June 25, 2015, sponsored by the Global Association of Risk Professionals. He praised the Basel III regulation on liquidity risk. […]

Update on Central Clearing

One of the goals of the Dodd-Frank Act is to mitigate systemic financial risk by establishing a central clearinghouse for derivatives. But how close is the financial community toward achieving that goal? “Many swaps were not collateralized prior to Dodd-Frank,” said Julian E. Hammar, Of Counsel at Morrison & Foerster. Hammar was the third of four presenters at the Derivatives Regulatory Update webinar held on March 31, 2015, sponsored by the Global Association of Risk Professionals. Clearing swaps mitigates risk not just through requiring margin collateral (and thereby reducing) credit risk. It also imposes an “operational discipline” Hammar said, with […]

Public vs Private Banks in India and China

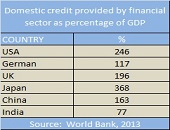

“Public sector banks perform worse than private banks In India whereas there is no significant performance difference for the two sectors in China,” said Dr. Rajan Singenellore, Global Head of the Default Risk and Valuation Group at Bloomberg. He gave an overview of operational performance and credit risk trends in Banking in Emerging Markets, and was the third of three webinar panellists on November 20, 2014, organized by the Global Association of Risk Professionals. For both countries, Singenellore compared government-owned banks with private sector banks. The terminology is different: India has public sector undertakings (PSU) banks whereas China has state-owned […]

“Expect More Niche Customer Targeting”

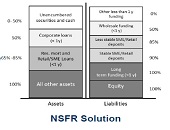

In India and China, “large state-owned banks often have a significant constraint on their ability to manage liabilities,” said Professor Moorad Choudhry from the Department of Mathematical Sciences at Brunel University and author of Principles of Banking. He was the second of three panellists at the webinar Banking in Emerging Markets held on November 20, 2014, organized by the Global Association of Risk Professionals, and his role was to describe “operational realities.” The 2018 advent of new Basel III rules for capital and liquidity requires 100 percent compliance with new rules on the liquidity coverage ratio (LCR) and the net […]

“Lending Will Be Marketing Gimmick”

What will be the effect of Basel III on banks in emerging markets? “Commercial banks will become less interested in providing loans,” said Dr. Michael C. S. Wong, the first panellist in a webinar on Banking in Emerging Markets held November 20, 2014, and sponsored by the Global Association of Risk Professionals. He is Associate Professor of Finance at City University of Hong Kong, and Chairman at CTRISKS Rating. Wong summarized the challenges of the new Basel III regulatory regime, with its tougher capitalization and liquidity requirements. A global systemically important bank (G-SIB) will have additional capital and cash-holding requirements, he said, […]