Basel III Standardized: Avoid the Showstopper

“If you can’t comply, it could be a showstopper,” said Henry Fields, Partner at Morrison & Foerster LLP, who was the first of two panellists at a webinar held on September 16, 2014, organized by the Global Association of Risk Professionals. The purpose of the webinar was to discuss the Basel III Standardized Approach for mid-tier banks (assets of over $500 million), and Fields began by giving an overview. The potential “showstopper” would be non-compliance with the new rules for risk weights for assets that are scheduled to come into effect January 1, 2015. “When the Fed issued the [new] […]

DFAST 1. Modeling Losses and Provisions Over Time

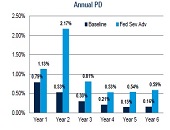

Although Dodd-Frank Act Stress Testing (DFAST) requirements may be the primary motivation for bringing stress testing to the forefront, they should not be the only reason a bank explores the components of loan loss forecasting under a stressed scenario, said Chris Henkel, Senior Director, Enterprise Risk Solutions at Moody’s Analytics. He was the first of two panelists at a webinar held on September 9, 2014, sponsored by the Global Association of Risk Professionals. An accurate forecast of charge-offs is crucial, Henkel said, so that a firm “can estimate what allowances should be and how large the provisions should be,” thereby […]

Risk Units & Risk Accounting

“In the absence of a standardized and universally accepted method of calculating exposure to risk, are accuracy, integrity and timeliness achievable?” asked Peter Hughes, Managing Director, Financial InterGroup (UK). He was the fourth of four panellists to present at the GARP webinar on risk data aggregation held July 22, 2014. Hughes was speaking with reference to the Basel Committee on Banking Supervision (BCBS) article 239, which spells out principles of accuracy, integrity, and timeliness for risk data. There’s a mixed bag of methods used to identify and quantify exposure to risk, Hughes noted. Quantitative modelling, accounting methods, key risk indicators, […]

Where is the Common Thread?

Thanks to “Rube Goldberg infrastructure” and a lack of attention, banks “have been mixing together data that have no common thread,” said Allan D. Grody, founder of Financial InterGroup Holdings. “Now is our chance to fix the plumbing.” Grody was the third of four panellists to address the July 22, 2014 GARP webinar on changes to risk data aggregation and reporting. His talk continued a theme of improved risk data management that he has spoken about before to GARP audiences. The “astonishing” aftermath of the 2008 Lehman fiasco—where banks were scrambling to determine exposure to a bankrupt counterparty—“has become the […]

Swap Data Reporting

One of the primary purposes of swap data reporting, as explained by James Schwartz, Counsel at Morrison & Foerster LLP, is to permit regulators to identify the swap exposures of market participants—which they found themselves unable to do during the financial crisis. Schwartz spoke as part of a four-person panel on challenges to risk data aggregation, reporting and recordkeeping organized by GARP on July 22, 2014. Schwartz gave an overview of the US swap data reporting requirements under the Dodd-Frank Act. “It’s important to note timing,” he said with regard to U.S. Commodity Futures Trading Commission (CFTC) regulations and Basel […]

Challenges to Risk Data Aggregation: Overview

Will financial institutions be able to respond to new challenges of risk data aggregation, reporting and record-keeping? Peter J. Green, Partner of Morrison & Foerster LLP, opened the four-panellist webinar organized by GARP on July 22, 2014, to discuss new risk data aggregation, risk reporting and recordkeeping principles. He indicated that the recent financial crisis had caused regulators to see many gaps in risk reporting and aggregation due to deficiencies in banks’ IT and data architecture. The Financial Stability Board (FSB) gave a mandate to the Basel Committee on Banking Supervision (BCBS) “to develop principles for effective risk data aggregation […]

Counterparty Credit Risk 3. Modelling

“Counterparty credit risk is particularly difficult” to model due to its “bilateral nature” and the fact it often covers more than one year, said Rajan Singenellore, Global Head of the Default Risk and Valuation Group at Bloomberg. He was the third of three presenters at a GARP webinar on counterparty risk held on May 20, 2014. Singenellore divided the challenges to modelling counterparty risk into three categories. The first, the counterparty’s probability of default (PD), depends on multiple factors and requires estimates of recovery. The second category is how to estimate the future value of securities, which depends on the […]

Counterparty Credit Risk 2. The Good, the Bad, the Ugly, and the Unseen

“Data and its accuracy are key to making this work,” said Robert Scanlon, referring to counterparty credit risk. Scanlon is the former Group Chief Credit Officer of Standard Chartered Bank and current Principal, Scanlon Associates. As the second of three speakers at a GARP webinar on counterparty risk held on May 20, 2014, Scanlon spoke from years of experience with risk practices. First, the good part of calculating counterparty credit risk. Scanlon said there is plenty of data already, especially for consumer/retail transactions. “You can start with a steady state assumption and get more data as time goes on. Ask […]

Counterparty Credit Risk 1. Regulatory Landscape

“Things got out of control very quickly” during the collapse of Lehman Brothers, said Cady North, Senior Finance Analyst for Bloomberg Government, as she compared counterparty credit risk analysis before and after Dodd-Frank legislation was enacted. North was the first of three speakers at a webinar held on May 20, 2014, sponsored by the Global Association of Risk Professionals. The webinar attracted a record number of registrants. Prior to the financial crisis of 2007, “no regulatory reporting was going on for counterparty risk on a regular basis,” North said. There was lack of a common legal entity identifier for Lehman […]

OTC Market 2. A New Paradigm

“How will errors be handled? That’s the biggest area of discussion with SEFs,” said Bis Chatterjee, Global Head of E-Trading and New Business Development, Credit Markets, at Citigroup Global. SEF refers to a Swap Execution Facility. He was the second of two speakers at a GARP-sponsored webinar, about changes to the over-the-counter (OTC) credit default swaps (CDS) market, held on April 15, 2014. “The market had less time than it would have liked to review various rules of the new guideline,” Chatterjee said, referring to the flurry of market response to the new regulations brought in by the US Commodities Futures […]