It’s all about the benchmark

The costs of financial transactions (in either the bond or stock markets) are quoted as bid and ask prices relative to the prevailing market price. But what, really, is meant by “prevailing market price” of thinly traded bonds? Two panellists discussed fixed income transaction cost analysis (TCA) at a webinar sponsored by the Global Association of Risk Professionals on December 12, 2017. Paul Daley, Managing Director at BondWave Information Lab, compared the market microstructure for stocks and bonds. BondWave LLC is a financial technology company and registered investment advisor that provides solutions to facilitate individual bond investing. “Data is the […]

Lower Bond Trading Costs

As the fixed income market evolves, what are the challenges and general directions of transaction cost analysis (TCA)? How can bond investors spend their money more wisely? “The same kind of conversation we used to have with equity dealers … can now occur with fixed income dealers. That means competition will drive down transaction costs,” said Henry Marigliano, Director at FIS Global Trading. FIS is an international provider of financial services technology. He was the was the first of two panellists discussing fixed income transaction cost analysis at a webinar sponsored by the Global Association of Risk Professionals on December […]

Pension Plan Risk, Old and New

“It’s not about volatility of returns; it’s about volatility of funded status,” said William da Silva, Senior Partner at AON Hewitt, a multinational company specializing in risk management and human resources. He was referring to financial risk management in the face of the developing pension crisis. He was the second of two speakers on the evening of January 30, 2014 at the GARP Toronto Chapter meeting held at First Canadian Place at King & Bay, Toronto. “It’s been a decade of pain,” da Silva said, noting that the median solvency ratio of pension plans had gone from a healthy 110 percent funded […]

Contingent Capital: The Case for COERCs. Part 2.

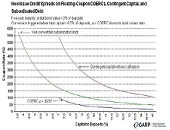

“Many people have misgivings about [contingent convertible bonds] because they just don’t know how to value them,” said George Pennacchi, Professor of Finance at University of Illinois. He was the second speaker at the November 29, 2012 GARP webinar on the subject of Call Option Enhanced Reverse Convertible (COERC) bonds. Click here to go to Part 1. Pennacchi, along with Theo Vermaelen and Christian Wolff, co-authored a recent paper proposing a new type of cocobond. [Contingent convertible bonds, or “cocobonds,” are bonds that convert into equity when the market value of capital falls below a trigger level.] “The paper provides a […]

Joost Driessen Discusses Liquidity Effects in Bonds

Put away the crossword and the sudoku: it’s the “credit spread puzzle” that’s occupying some leading financial minds. On May 3, 2012, Prof. Joost Driessen of Tilburg University spoke to a Global Association of Risk Professionals (GARP) webinar audience about recent work done by his research group to solve this puzzle. The term “credit spread puzzle” refers to the fact that credit spreads are much higher than can be justified by historical default losses. A typical example Driessen cited was a long-term AA bond that had an expected default loss of 0.06% yet whose average credit spread, calculated using real-life data, was 1.18%. More […]