As the fixed income market evolves, what are the challenges and general directions of transaction cost analysis (TCA)? How can bond investors spend their money more wisely?

“The same kind of conversation we used to have with equity dealers … can now occur with fixed income dealers. That means competition will drive down transaction costs,” said Henry Marigliano, Director at FIS Global Trading. FIS is an international provider of financial services technology. He was the was the first of two panellists discussing fixed income transaction cost analysis at a webinar sponsored by the Global Association of Risk Professionals on December 12, 2017.

In the current landscape, Marigliano said, “competition is as fierce as ever. On the sell side, competition has driven down costs—and has also pushed brokers to improve technology.”

TCA is a mature field, around since the 1990s, and he predicted, “New MiFID II regulations will push it even further.” The most recent version of the Markets in Financial Instruments Directive (MiFID II) in Europe was delayed by a year until January 3, 2018, to allow computer systems to be adapted.

TCA has “created an environment where broker dealers can no longer charge whatever they want to,” Marigliano said. This means the area is ripe for development of advanced algorithms, and advanced TCA.

The current state of fragmentation in the markets is so extreme that, to outside viewers, “it would look completely crazy to them,” he said. Compared to the costs of trading 20 years ago, however, investors would prefer the cost savings of today. “We feel this current market structure will lead to lower costs.”

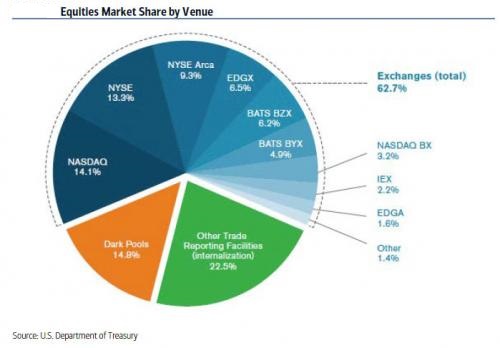

Marigliano showed a pie chart of fragmentation in the US equity market structure. “Fixed income will look similar to this,” he said. The fixed income market might start to look complicated, “but fragmentation has greatly benefited investors” over time.ª

Click here to read about the second presentation.

The pie-chart showing equity market fragmentation is from the ZeroHedge website, http://www.zerohedge.com/news/2017-10-09/where-us-stocks-are-traded-today . Henry Marigliano’s presentation included a more detailed structure.