Managing Risk in Volatile Sector

Market observers have conflicting expectations, especially in the highly changeable energy sector. How can a talented analyst stay on top of it? Mehna Raissi, Senior Director at Moody’s Analytics, was the second of three panellists discussing new dynamics in the handling of financial risk management in the energy sector at a webinar sponsored by the Global Association of Risk Professionals on November 29, 2017. “Between 2008 and 2013, we were worried about rising oil prices,” Raissi said. However, “in the second half of 2014, oil prices came down and the headlines read: Recession caused by low oil prices.” Oil prices […]

Central Clearing Design

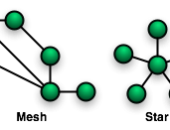

If you had to design a central clearinghouse for transactions in financial markets, what size of guarantees should be offered? And what percentage fees should be charged? “The central clearing modifies the market,” said Andreea Minca, “because the old network structure [of one-to-one] is changing to a new ‘star’ structure.” Minca is Assistant Professor at the School of Operations Research and Information Engineering at Cornell University and was the sole presenter at the December 6, 2016, webinar on systemic risk and central clearing design to members of the Global Association of Risk Professionals (GARP). Under new US legislation, all over-the-counter […]

Swaps, Before & After

“Historically, there were few, if any, regulatory requirements on swaps … it was effectively an unsecured loan,” said James Schwartz, Of Counsel at Morrison & Foerster. He was the fourth and final presenter at the Derivatives Regulatory Update webinar held on March 31, 2015, sponsored by the Global Association of Risk Professionals. Prior to the Dodd-Frank Act, swaps dealers were self-regulated through the trade association International Swaps and Derivatives Association (ISDA). “It was typical for the two parties to accept a certain amount of uncollateralized exposure to each other in the form of a threshold that varied according to their […]

Update on Central Clearing

One of the goals of the Dodd-Frank Act is to mitigate systemic financial risk by establishing a central clearinghouse for derivatives. But how close is the financial community toward achieving that goal? “Many swaps were not collateralized prior to Dodd-Frank,” said Julian E. Hammar, Of Counsel at Morrison & Foerster. Hammar was the third of four presenters at the Derivatives Regulatory Update webinar held on March 31, 2015, sponsored by the Global Association of Risk Professionals. Clearing swaps mitigates risk not just through requiring margin collateral (and thereby reducing) credit risk. It also imposes an “operational discipline” Hammar said, with […]

“Skin in the Game”

What safeguards should be in place, to minimize the risks posed by financial derivatives? CME Group requires that its Clearing Members support the risk of their portfolios by “putting some skin in the game,” said Jason Silverstein, Executive Director and Associate General Counsel of CME Group, a body that includes the Chicago Mercantile Exchange and the New York Mercantile Exchange among its subsidiaries. “It’s a story of balancing incentives, in order to stabilize losses. Our belief is that it should be significant and risk-based.” Silverstein was the second of four presenters at a webinar titled Derivatives Regulatory Update held on […]

Towards Reducing Systemic Risk

Have the risks posed by financial derivatives in the context of the current, still evolving, regulatory landscape been properly addressed? Michael Piracci, Director of PCB Compliance at Barclays, said that nowadays he has “a lot of interactions day-to-day with the clearinghouse” and overall, “it makes me feel a little more comfortable there’s a good system in place.” Piracci was the first of four presenters at a webinar titled Derivatives Regulatory Update held on March 31, 2015, sponsored by the Global Association of Risk Professionals. Piracci began by explaining the role of the Central Counterparty (CCP) and the Futures Commission Merchants […]

Counterparty Credit Risk 3. Modelling

“Counterparty credit risk is particularly difficult” to model due to its “bilateral nature” and the fact it often covers more than one year, said Rajan Singenellore, Global Head of the Default Risk and Valuation Group at Bloomberg. He was the third of three presenters at a GARP webinar on counterparty risk held on May 20, 2014. Singenellore divided the challenges to modelling counterparty risk into three categories. The first, the counterparty’s probability of default (PD), depends on multiple factors and requires estimates of recovery. The second category is how to estimate the future value of securities, which depends on the […]

Counterparty Credit Risk 2. The Good, the Bad, the Ugly, and the Unseen

“Data and its accuracy are key to making this work,” said Robert Scanlon, referring to counterparty credit risk. Scanlon is the former Group Chief Credit Officer of Standard Chartered Bank and current Principal, Scanlon Associates. As the second of three speakers at a GARP webinar on counterparty risk held on May 20, 2014, Scanlon spoke from years of experience with risk practices. First, the good part of calculating counterparty credit risk. Scanlon said there is plenty of data already, especially for consumer/retail transactions. “You can start with a steady state assumption and get more data as time goes on. Ask […]

Counterparty Credit Risk 1. Regulatory Landscape

“Things got out of control very quickly” during the collapse of Lehman Brothers, said Cady North, Senior Finance Analyst for Bloomberg Government, as she compared counterparty credit risk analysis before and after Dodd-Frank legislation was enacted. North was the first of three speakers at a webinar held on May 20, 2014, sponsored by the Global Association of Risk Professionals. The webinar attracted a record number of registrants. Prior to the financial crisis of 2007, “no regulatory reporting was going on for counterparty risk on a regular basis,” North said. There was lack of a common legal entity identifier for Lehman […]

OTC Market 2. A New Paradigm

“How will errors be handled? That’s the biggest area of discussion with SEFs,” said Bis Chatterjee, Global Head of E-Trading and New Business Development, Credit Markets, at Citigroup Global. SEF refers to a Swap Execution Facility. He was the second of two speakers at a GARP-sponsored webinar, about changes to the over-the-counter (OTC) credit default swaps (CDS) market, held on April 15, 2014. “The market had less time than it would have liked to review various rules of the new guideline,” Chatterjee said, referring to the flurry of market response to the new regulations brought in by the US Commodities Futures […]