Market observers have conflicting expectations, especially in the highly changeable energy sector. How can a talented analyst stay on top of it? Mehna Raissi, Senior Director at Moody’s Analytics, was the second of three panellists discussing new dynamics in the handling of financial risk management in the energy sector at a webinar sponsored by the Global Association of Risk Professionals on November 29, 2017.

“Between 2008 and 2013, we were worried about rising oil prices,” Raissi said. However, “in the second half of 2014, oil prices came down and the headlines read: Recession caused by low oil prices.”

Oil prices have stabilized since Q2 2016, she pointed out, but “the rate of defaults among oil companies is still high.”

Lenders are still cool toward energy companies. Raissi said that 54 percent of firms in the energy sector have experienced a reduction in loan commitments. In other sectors, only 18 percent have experienced a reduction.

“The energy sector default rate is correlated with commodity prices,” she noted. When the price of oil dipped below $50 a barrel in Q4 2015, the default rate climbed.

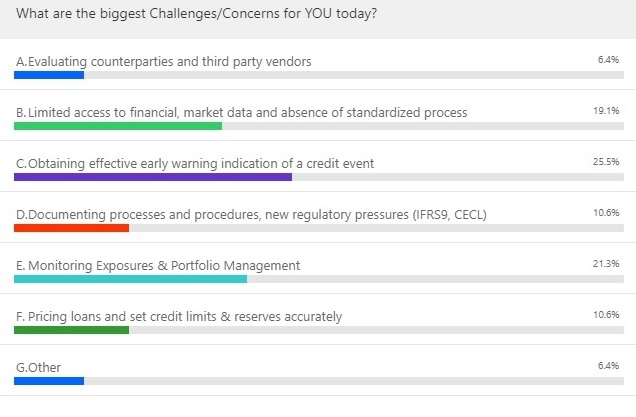

“There are common industry challenges,” Raissi said. For example, during times of volatility, every industry is challenged by limited access to up-to-date financial and market data. Every industry wants early warning of credit events.

After presenting a slide with six areas of challenge, Raissi polled the webinar audience: “What are your biggest challenges or concerns today?” The majority said their biggest challenge was “receiving early warning of a credit event.” (Results shown here.)

Raissi also spoke about use of the expected default frequency (EDF) in practice. Firms struggle with questions about how to measure aggregate risk, and the risk of counterparties. For portfolio risk reporting, clients want real-time portfolio diagnostics.

Raissi showed examples of the risk reporting tools available through Moody’s.

“Analyzing financial ratios of similar firms will give a lot more insight into your day-to-day portfolio management,” she concluded. ª

Click here to read about the first panellist’s presentation.

Click here to read about the third panellist’s presentation.

Click here to view the 3-panellist, 50-minute GARP Webcast- New Dynamics in the Energy Sector: Best Practices for Managing Risk in a Volatile Business Environment

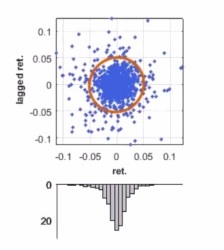

The first chart appears in the presentation (permission pending).