Modeling Sovereign Risk. Part 1: Emerging Markets

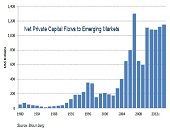

“Country-specific factors such as government debt and the sovereign credit rating change slowly but global aggregates such as the risk appetite change quickly, thus leading to confusion the part of observers,” said Michael Rosenberg, Foreign Exchange Consultant, Bloomberg and author of Currency Forecasting: A Guide to Fundamental and Technical Models of Exchange Rate Determination. He was the first of two speakers to address a GARP webinar audience on September 12, 2013. Much of Rosenberg’s talk focused on the sovereign credit risk of emerging markets (EM), because the accelerating flow of net private capital into EM from 1980-2014 has been unprecedented. […]

The Fed, Foreign Banks and Basel III: Part 2. Capital Concerns

“Some of the rules are in direct conflict,” said Peter Went, VP, Banking Risk Management Programs, GARP. He was the second speaker at a webinar presented on February 14, 2013 organized by the Global Association of Risk Professionals (GARP) regarding regulatory reform of foreign banking operations (FBOs) in the United States and the implementation of the Basel III framework. The “conflict” refers to rules in the Dodd-Frank Act versus the globally agreed Basel III Accord’s guidelines. Both regulatory attempts apply the G-20 principles on financial regulation (Pittsburgh 2009 summit). The US implementation of the Basel III framework differs from the […]

Managing Risk Beyond Asset Class Diversification

“The ‘new normal’ in asset allocation must be forward-looking and driven by macroeconomics, said Sébastien Page, Global Head of Client Analytics, Executive Vice-President at PIMCO. He was addressing a CFA Society Toronto luncheon on October 15, 2012 in Toronto’s historic National Club. Traditionally, asset allocation focussed on diversifying according to asset class. In the ‘new normal,’ Page recommends diversifying across risk factors. “Think of asset class as simply a container of risk factors,” he suggested. He gave another metaphor in line with the luncheon crowd. “Think of risk factors as components like proteins, carbohydrates, and fats. An asset class would […]