“Country-specific factors such as government debt and the sovereign credit rating change slowly but global aggregates such as the risk appetite change quickly, thus leading to confusion the part of observers,” said Michael Rosenberg, Foreign Exchange Consultant, Bloomberg and author of Currency Forecasting: A Guide to Fundamental and Technical Models of Exchange Rate Determination. He was the first of two speakers to address a GARP webinar audience on September 12, 2013.

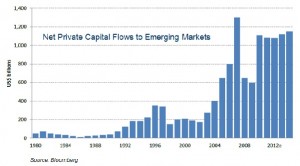

Much of Rosenberg’s talk focused on the sovereign credit risk of emerging markets (EM), because the accelerating flow of net private capital into EM from 1980-2014 has been unprecedented. Investors have shown “a major surge” in capital invested in EM over the last decade, he said. (See graph.)

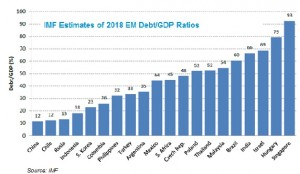

Growth of investment in a country is predictable. Rosenberg enumerated 13 key drivers of international investment in EM, beginning with low government debt/GDP ratios, and strong gross domestic product (GDP) growth relative to G-10 growth.

Over the past two hundred years, 107 countries have defaulted, he said. There were four intervals of “global defaults”: 1820s, 1870s, 1930s, and the 1980s Latin American debt crisis. In response to an audience question, he agreed there are a variety of ways to define default: missing payments on interest or principal, inability to pay long-term or short-term debt. The common element of all of these is that there was full or partial repudiation of what a country owes, followed by restructuring of its financial commitments.

There are fewer defaults nowadays, Rosenberg noted, because the EM countries have become more aware of the reputational risk. “If you have a history of default, you have wider spreads persisting well into the future.”

The level of indebtedness in EM countries is lower than most G-10 nations. He compared the government debt-to-GDP ratios for G-10 and EM countries. (See graph; data from the International Monetary Fund.)

Investors are not as insistent on having dollar-denominated debt, Rosenberg said. The fear used to be that debt denominated in the local currency could be erased by local markets “inflating their way out of debt.” However, now the local-currency debt is “attractive to investors due to diversification.”

There are many variables that could go into economic models of sovereign spread. Rosenberg pored over academic research and found about 20 country-specific variables (such as the budget deficit/GDP ratio), and about 12 global risk aversion indicators (such as the US Fed funds rate and the VIX index).

Political risk is tracked by some organizations such as the Economist, which maintains a database, but the problem in quantifying this type of risk, said Rosenberg, “is to come up with a rigorous framework.”

He pointed out three challenges that robust and reasonably accurate models must address in their “macro view” of sovereign spreads:

(1) Non-linearities occur. “Spreads may widen significantly once a threshold is reached.”

(2) The coefficients are time-varying. “Financial markets respond more to macro variables than they did before.”

(3) The model must accommodate global liquidity and volatility, which can magnify effects.

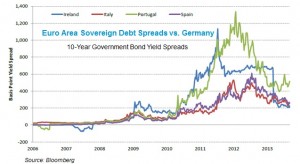

Sovereign debt risk and banking sector vulnerabilities abound. The spread widening leads to deterioration of the banking system, a decline in bank lending, and a decline in GDP growth.

Reverse transmission can occur. A decline in asset prices can lead to deterioration of markets, followed by government bailouts, followed by a rise in the budget deficit, leading to an increase in spreads.

Portugal and Ireland looked worst on the chart of Euro area sovereign debt spreads, expressed as a ratio to Germany’s debt spreads. (See Euro area graph.) Now that the US Fed is set to taper interest rates, EM yields are increasing, noted Rosenberg.

In response to a question from the audience: whether counter-cyclical buffers would improve the stability of markets, Rosenberg said the idea was “nice in theory” but it might create other non-linearities and thus might not work in real life.

The counter-cyclical buffer is poised to become another piece of the sovereign risk model. ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=671407&s=1&k=907DC03AC48BC5B9B0D994B76812F199>