Fixing Broken Windows 1. Game Changers and Whistleblowers

There is renewed focus on “pursuing small violations to prevent a culture where laws are not viewed as toothless guidelines,” said Amy Poster, Director for Risk and Regulatory Advisory Services at C & A Consulting LLC. She was the opening speaker in a four-part webinar panel titled “Fixing the Financial Industry’s Broken Windows” sponsored by GARP on March 11, 2014. Poster opened with a quote from a speech by Mary Jo White, Securities and Exchange Commission Chair: “The theory is that when a window is broken and someone fixes it – it is a sign that disorder will not be […]

Ain’t Misbehavin’. Part 2: What Makes a Good Committee?

“Good committees make good decisions,” said Arnold Wood, guest speaker at the CFA Society Toronto on June 3, 2013. On the TV show Who Wants to Be a Millionaire, whenever the contestant turns to the crowd for help with an answer, the crowd is right 91 percent of the time, said Wood, who is president and CEO of Martingale Investments and a specialist in behavioural finance. The first part of his talk described common errors in individual thinking. But what makes a good committee? The composition of committees can be tricky. Too often, there is an appearance of diversity but […]

Ain’t Misbehavin’. Part 1: Overconfidence and Illusion

“It’s not our ability that makes us, it’s our choices.” With this quotation from Harry Potter, Arnold Wood, President and CEO of Martingale Investments proceeded to show how, in case after case, a good grasp of behavioural finance could explain the workings of the typical investment committee. Wood was speaking to a few dozen charterholders at a luncheon sponsored by the CFA Society Toronto at the historic National Club in Toronto on June 3, 2013. Wood wove his commentary around three themes: key habitual errors of decision-making, the composition of committees, and the behaviour of the chair of the investment […]

Financial Shenanigans: Forensic Accounting in Practice

There are ample opportunities for financial shenanigans in North American companies, according to Howard Schilit, founder of Schilit Forensics LLC and author of the classic Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports, first published in 1993 and now in its third edition. He led a mid-day seminar on characteristics of poor accounting practices at the CFA Society Toronto downtown offices on May 30, 2013. “Financial shenanigans are not necessarily illegal,” explained Schilit, but they are practices that “are not nice to perpetrate on someone” and could, if unchecked, slip into criminality. Given the extensive subject […]

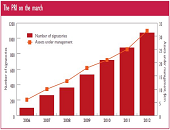

Spotting Signs of Poor Corporate Governance. Part 2: ESG Management

Corporate governance is only one part of an overall phenomenon known as “ESG management,” or how a company handles environmental, social, and corporate governance (ESG) issues. “Research shows that companies that disclose more ESG information are more likely to enjoy a lower cost of capital,” said Max Zehrt, Senior Manager at Sustainalytics. He was addressing a noon-hour seminar of financial analysts and portfolio managers on the subject of corporate governance on May 8, 2013 at the offices of the CFA Society Toronto. His talk was the second part of a two-speaker panel moderated by Toby Heaps of Corporate Knights. Zehrt was […]

Al Rosen: Latest Trends in Financial Deception

“Canada is changing. There’s a return to yield games” and manipulation of operating cash flow, said Al Rosen on October 25, 2012. He was addressing about 40 people at a CFA Society Toronto luncheon seminar on the topic “Latest Trends in Financial Deception.” Rosen is co-founder of Accountability Research Corporation (ARC), the investment research arm of Rosen & Associates Limited, a forensic accounting firm, and co-author of Swindlers: Cons & Cheats and How To Protect Your Investments From Them published by Madison Commerce Press in 2010. Rosen does not like the loose guidelines of the International Financial Reporting Standards (IFRS) in Canada. He paraphrased it thus: […]

Ethics and Risk Management: Part 3

A panel of four specialists convened to discuss various aspects of ethics in risk management in a GARP-sponsored webinar on June 21, 2012. (Click for Part 1 and Part 2 of this summary.) The fourth and final speaker was Roger Miles, Director, NudgeGlobal. He spoke on risk control lessons learned from the banking crisis. In the financial sector, he said, “UK-enforced self-regulation was a good idea in theory.” A bank can realize an ever-increasing profit from a new, complex product, but the regulator has limited resources, therefore, there is an essential asymmetry of information that cannot be overcome. However, in […]

Ethics and Risk Management: Part 2

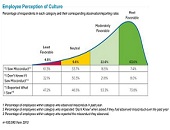

A panel of four specialists convened to discuss various aspects of ethics and risk management in a GARP-sponsored webinar on June 21, 2012. Part I of this blog posting summarizes comments by Peter Went and Hans Helbekkmo. The third speaker was Dan Currell, Executive Director, Corporate Executive Board (CEB). He presented empirical findings from the CEB on-line survey that asked essentially two questions: “Have you seen misconduct? And if so, what was it?” I have mixed feelings when I listen to survey results. I listen as someone who craves a snapshot of current opinion; I also listen as someone who […]

Ethics and Risk Management: Part I

Risk professionals are called upon to monitor, measure, and manage risk throughout corporations. It’s all too easy to get caught in the thicket of regulations, methodology, and topical issues. Thank heavens that that, every once in a while, the Global Association of Risk Professionals (GARP) encourages its membership to look at the bigger picture: ethics. A panel of four specialists convened to discuss various aspects of ethics in risk management in a webinar on June 21, 2012. When it comes to doing the right thing, it is no longer just a good conscience that should motivate someone to report unethical […]