Corporate governance is only one part of an overall phenomenon known as “ESG management,” or how a company handles environmental, social, and corporate governance (ESG) issues. “Research shows that companies that disclose more ESG information are more likely to enjoy a lower cost of capital,” said Max Zehrt, Senior Manager at Sustainalytics. He was addressing a noon-hour seminar of financial analysts and portfolio managers on the subject of corporate governance on May 8, 2013 at the offices of the CFA Society Toronto. His talk was the second part of a two-speaker panel moderated by Toby Heaps of Corporate Knights.

Zehrt was referencing a 2012 study by Dhaliwal, Li, and Tang that found an inverse relationship between voluntary nonfinancial disclosure, such as reporting on ESG metrics, and the cost of equity capital. [Note: the study calls these CSR metrics, short for corporate social responsibility.]

Zehrt posed the question: “How well is a company prepared to deal with an ESG shock?” Corporate leaders should think ahead about how to protect their companies from human rights or governance issues that could pose grave reputational risk. The most immediate effect of such a shock is usually a drop in share price, when negative news hits the market, said Zehrt. Shareholders immediately begin to factor in future increased costs due to operational risk (accidents, pollution, strikes) and supply chain risk (natural resources and workers’ environment).

Corporate leaders should build resiliency into their companies ahead of time by good communication and disclosure practices. Zehrt recommended that analysts develop a set of metrics that would show how well prepared a company was, in the event of an ESG shock.

“Lots of people are doing fundamental analysis,” Zehrt said, “but ESG gives you a different view (and provides a stronger sense how companies are managing their entire stakeholder exposure).”

Investors are exploring more often how to operationalize ESG within their investment process. While many look at it through a risk management lens, others are seeking its alpha generating potential. Zehrt described construction of one “ESG-tilted portfolio” in which companies are ranked on a given set of ESG metrics. The portfolio manager could short the bottom 10 percent and go long the top 10 percent companies.

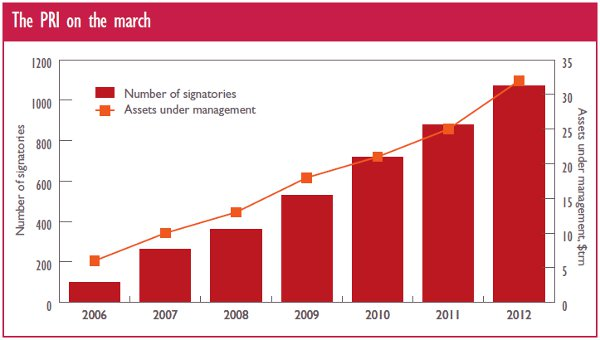

Zehrt provided context for ESG management, which grew out of Principles for Responsible Investment (PRI), a UN-driven initiative. The PRI are voluntary and aspirational, and as of March 2013 have about 1,200 signatory companies world-wide (growing yearly, as shown in the accompanying chart). The PRI offer a means to incorporate ESG issues into investment practices across asset classes.

One lightning rod for corporate governance has been executive compensation. [Ed. Note: See related postings on executive compensation and how CEOs game the system.] Zehrt discussed shareholder rights in the context of “Say-on-Pay,” a non-binding advisory vote on the structure of a company’s executive compensation plan. He referred to 2012 in the UK as “Shareholder Spring,” in which there were high levels of dissent at several large companies such as AstraZeneca. He noted that even Canada had its first Say-on-Pay majority vote against. Switzerland will soon have the strictest say-on-pay legislation.

Another indicator of poor corporate governance is whether there is gender diversity on the Board of Directors. Zehrt briefly touched on the Credit Suisse study that found a link between gender diversity and improved overall shareholder return . “Leadership styles of women provide complementary skills,” he said. “Diversity helps prevent group-think.”

Board accountability is another indicator of corporate governance, said Zehrt. When investors identify a board who isn’t performing, engagement (behind closed doors or collaboratively with other investors) is a strong tool to impart meaningful change. Shareholder activist William Ackman of Pershing Square Capital Management eventually won the fight against CP Rail. A year later, CP Rail is the best performing in its class, Zehrt noted—thanks in part to the forced changes.

Corporate governance is just one part of ESG management. And ESG management is one way to understand management quality, Zehrt concluded. ª

The graphic on PRI signatories is copyright Alex Hetherington. His blog is at: http://www.alexhetheringtonsustainabilityblog.com/