Ethics and Risk Management: Part 3

A panel of four specialists convened to discuss various aspects of ethics in risk management in a GARP-sponsored webinar on June 21, 2012. (Click for Part 1 and Part 2 of this summary.) The fourth and final speaker was Roger Miles, Director, NudgeGlobal. He spoke on risk control lessons learned from the banking crisis. In the financial sector, he said, “UK-enforced self-regulation was a good idea in theory.” A bank can realize an ever-increasing profit from a new, complex product, but the regulator has limited resources, therefore, there is an essential asymmetry of information that cannot be overcome. However, in […]

Ethics and Risk Management: Part 2

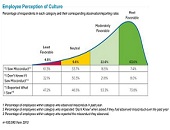

A panel of four specialists convened to discuss various aspects of ethics and risk management in a GARP-sponsored webinar on June 21, 2012. Part I of this blog posting summarizes comments by Peter Went and Hans Helbekkmo. The third speaker was Dan Currell, Executive Director, Corporate Executive Board (CEB). He presented empirical findings from the CEB on-line survey that asked essentially two questions: “Have you seen misconduct? And if so, what was it?” I have mixed feelings when I listen to survey results. I listen as someone who craves a snapshot of current opinion; I also listen as someone who […]

Ethics and Risk Management: Part I

Risk professionals are called upon to monitor, measure, and manage risk throughout corporations. It’s all too easy to get caught in the thicket of regulations, methodology, and topical issues. Thank heavens that that, every once in a while, the Global Association of Risk Professionals (GARP) encourages its membership to look at the bigger picture: ethics. A panel of four specialists convened to discuss various aspects of ethics in risk management in a webinar on June 21, 2012. When it comes to doing the right thing, it is no longer just a good conscience that should motivate someone to report unethical […]

Zombie Banks Part 1. Tough Love

George A. Romero, the moviemaker who popularized the witchcraft legend of the “walking undead,” would likely be astonished to hear the term applied to real financial institutions, but “Zombie banks” does capture the concept well. On June 5, 2012, Yalman Onaran, author of “Zombie Banks: How Broken Banks and Debtor Nations Are Crippling the Global Economy,” and financial reporter at Bloomberg News, spoke at a panel convened by GARP (Global Association of Risk Professionals) to discuss the phenomenon of banks which exist to fulfill a regulatory purpose but are not in themselves economically viable. Onaran said the first response to […]

“We Need to Fix the Plumbing”

Allan Grody is a man with a mission. The fall-out from the financial meltdown has shone a light on many things that need fixing within the financial system, and of these, Grody is focusing on one especially leaky, corroded pipe. Grody, president of Financial Intergroup, was addressing a GARP (Global Association of Risk Professionals) audience as the third of three panelists on “Modernizing Financial Risk Management: The Changing Technology Paradigm” on May 22, 2012. Early in his presentation, Grody showed a complex summation diagram. Titled “Need to Fix the Plumbing,” it was a kind of map, one that deserves a place […]

Joost Driessen Discusses Liquidity Effects in Bonds

Put away the crossword and the sudoku: it’s the “credit spread puzzle” that’s occupying some leading financial minds. On May 3, 2012, Prof. Joost Driessen of Tilburg University spoke to a Global Association of Risk Professionals (GARP) webinar audience about recent work done by his research group to solve this puzzle. The term “credit spread puzzle” refers to the fact that credit spreads are much higher than can be justified by historical default losses. A typical example Driessen cited was a long-term AA bond that had an expected default loss of 0.06% yet whose average credit spread, calculated using real-life data, was 1.18%. More […]