Allan Grody is a man with a mission. The fall-out from the financial meltdown has shone a light on many things that need fixing within the financial system, and of these, Grody is focusing on one especially leaky, corroded pipe. Grody, president of Financial Intergroup, was addressing a GARP (Global Association of Risk Professionals) audience as the third of three panelists on “Modernizing Financial Risk Management: The Changing Technology Paradigm” on May 22, 2012.

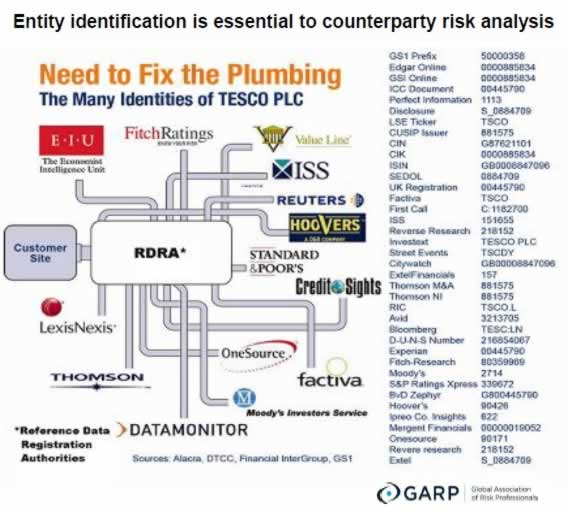

Early in his presentation, Grody showed a complex summation diagram. Titled “Need to Fix the Plumbing,” it was a kind of map, one that deserves a place on the wall—a daily reminder of how an important component will affect several levels of risk management.

The “bad pipe” that bothers Grody most is the lack of standardization in counterparty names. For example, forensic accounting at Lehman Brothers showed dozens of name and ID numbers were used to refer to a single counterparty most commonly known as “Tesco PLC,” the British supermarket giant. And that many-to-one correspondence was occurring within just a single firm. If it’s named as counterparty in third-party transactions, then it’s a many-to-many problem. No wonder that a reconciliation of counterparties between several financial institutions is unsuccessful in determining the true extent of indebtedness of a single corporation.

The “bad pipe” that bothers Grody most is the lack of standardization in counterparty names. For example, forensic accounting at Lehman Brothers showed dozens of name and ID numbers were used to refer to a single counterparty most commonly known as “Tesco PLC,” the British supermarket giant. And that many-to-one correspondence was occurring within just a single firm. If it’s named as counterparty in third-party transactions, then it’s a many-to-many problem. No wonder that a reconciliation of counterparties between several financial institutions is unsuccessful in determining the true extent of indebtedness of a single corporation.

Grody champions CCDM—a Central Counterparty for Data Management that would include a formal Registry of IDs. Each legal entity in the G20 that operates as a financial market participant would be compelled to register and annually verify their status and ID number. The CCDM would permit counterparty risk aggregation within financial institutions and across trade repositories. Grody made a strong case, showing how the new Legal Entity Identifier will improve transparency, risk aggregation, and regulatory

oversight. As far as fixing pipes goes, this primary identifier could well be the water main of the system. ª